10 Key Elements of the SOX Compliance Framework for Defense Contractors

Explore the essential elements of the SOX compliance framework for defense contractors.

Introduction

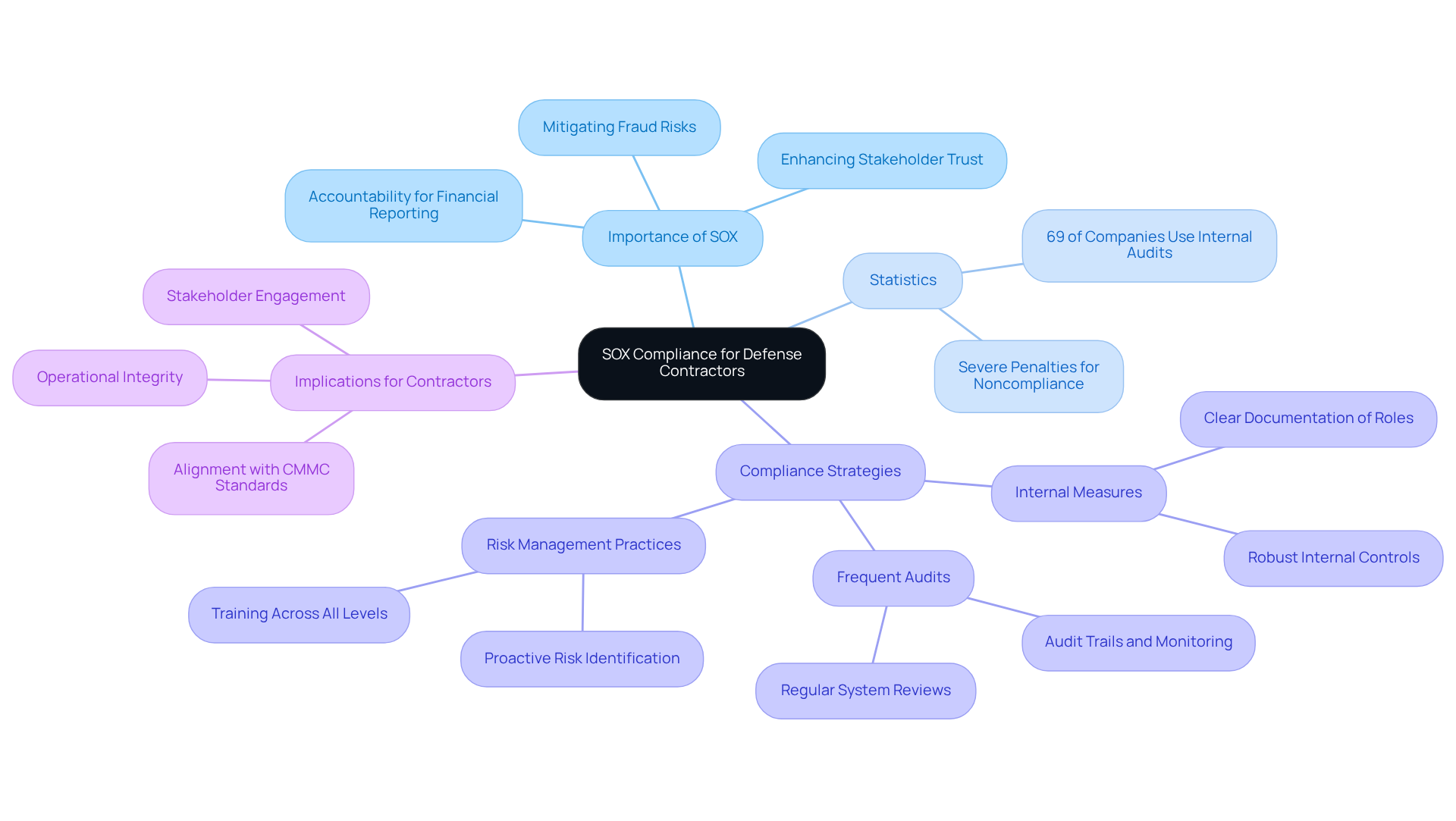

Understanding the complexities of the Sarbanes-Oxley Act (SOX) compliance framework is essential for defense contractors operating in a highly regulated environment. Did you know that around 69% of publicly traded companies depend on internal audits to effectively manage their SOX programs? This statistic underscores the critical need for robust compliance strategies.

With recent updates placing greater emphasis on internal controls and the financial risks associated with non-compliance, how can contractors protect their operations and uphold stakeholder trust? This article explores ten key elements of SOX compliance, providing insights and actionable strategies specifically designed for defense contractors. By aligning with regulatory standards and ethical business practices, you can navigate the challenges of compliance with confidence.

CMMC Info Hub: Your Comprehensive Guide to SOX Compliance for Defense Contractors

CMMC Info Hub serves as an essential resource for defense contractors aiming to grasp and implement the SOX compliance framework related to the Sarbanes-Oxley Act (SOX) adherence requirements. Did you know that approximately 69% of publicly traded companies rely on internal audits to manage their SOX programs? This statistic underscores the critical need for awareness of these regulatory mandates. The platform provides organized assistance, comprehensive articles, and practical strategies that empower organizations to navigate the complexities of SOX regulations effectively. This is especially vital for defense contractors who must align their operations with both CMMC and SOX standards, ensuring compliance with the stringent requirements set forth by the Department of Defense (DoD).

Recent updates to the Sarbanes-Oxley Act highlight the increasing responsibility of corporate boards and executives for the accuracy of financial statements, making adherence more crucial than ever. Expert insights reveal that effective internal oversight extends beyond finance and accounting; it necessitates thorough training across all organizational levels. What are some effective SOX adherence strategies for contractors?

- Establishing robust internal measures

- Conducting frequent audits

- Implementing proactive risk management practices

These strategies can significantly reduce the likelihood of fraud and enhance reporting accuracy.

By leveraging the insights and resources available through CMMC Info Hub, military contractors can transform their approach to compliance. This ensures they not only meet regulatory standards but also bolster their overall operational integrity and foster stakeholder trust.

Sarbanes-Oxley Act: Key Legal Framework for SOX Compliance

The Sarbanes-Oxley Act (SOX), enacted in 2002, stands as a crucial response to corporate scandals, designed to protect investors by enhancing the accuracy and reliability of corporate disclosures. This legislation imposes stringent reforms that strengthen corporate governance and accountability, particularly for publicly traded companies. Key provisions include:

- The establishment of robust internal oversight

- Strict reporting requirements

- The formation of independent audit committees

For defense contractors, navigating SOX regulations is not just important; it’s essential, as these regulations significantly shape their financial practices and obligations when engaging with government contracts.

Recent changes in SOX adherence requirements have heightened the focus on internal oversight, especially for government contractors. Companies are now required to allocate substantial budgets-often exceeding $1-2 million annually-to meet these regulatory standards. This financial commitment underscores the necessity of maintaining strong internal controls over reporting, as non-compliance can lead to severe penalties, including criminal charges for executives who certify false reports.

Current adherence rates among defense contractors reveal a growing awareness of SOX requirements, yet challenges remain. Notably, non-exempt companies face audit expenses approximately 19% higher than their exempt counterparts, highlighting the economic burden of compliance. Legal experts emphasize that the act places responsibility squarely on executives, mandating that CEOs and CFOs verify the accuracy of reports and the effectiveness of internal controls within 90 days of submission.

The impact of the SOX compliance framework on contractors in the security sector extends beyond mere compliance; it fundamentally transforms their financial practices. The SOX compliance framework has driven enhanced disclosure requirements and the need for regular audits, fostering improved transparency and accountability in reporting. As defense contractors adapt to these evolving standards, the emphasis on ethical practices and robust internal frameworks becomes increasingly critical for securing government contracts and maintaining investor confidence. Furthermore, whistleblower protections established under SOX, as noted by experts like Jason Zuckerman, reinforce the act's commitment to corporate accountability and ethical conduct.

Section 404: Management Assessment of Internal Controls in SOX Compliance

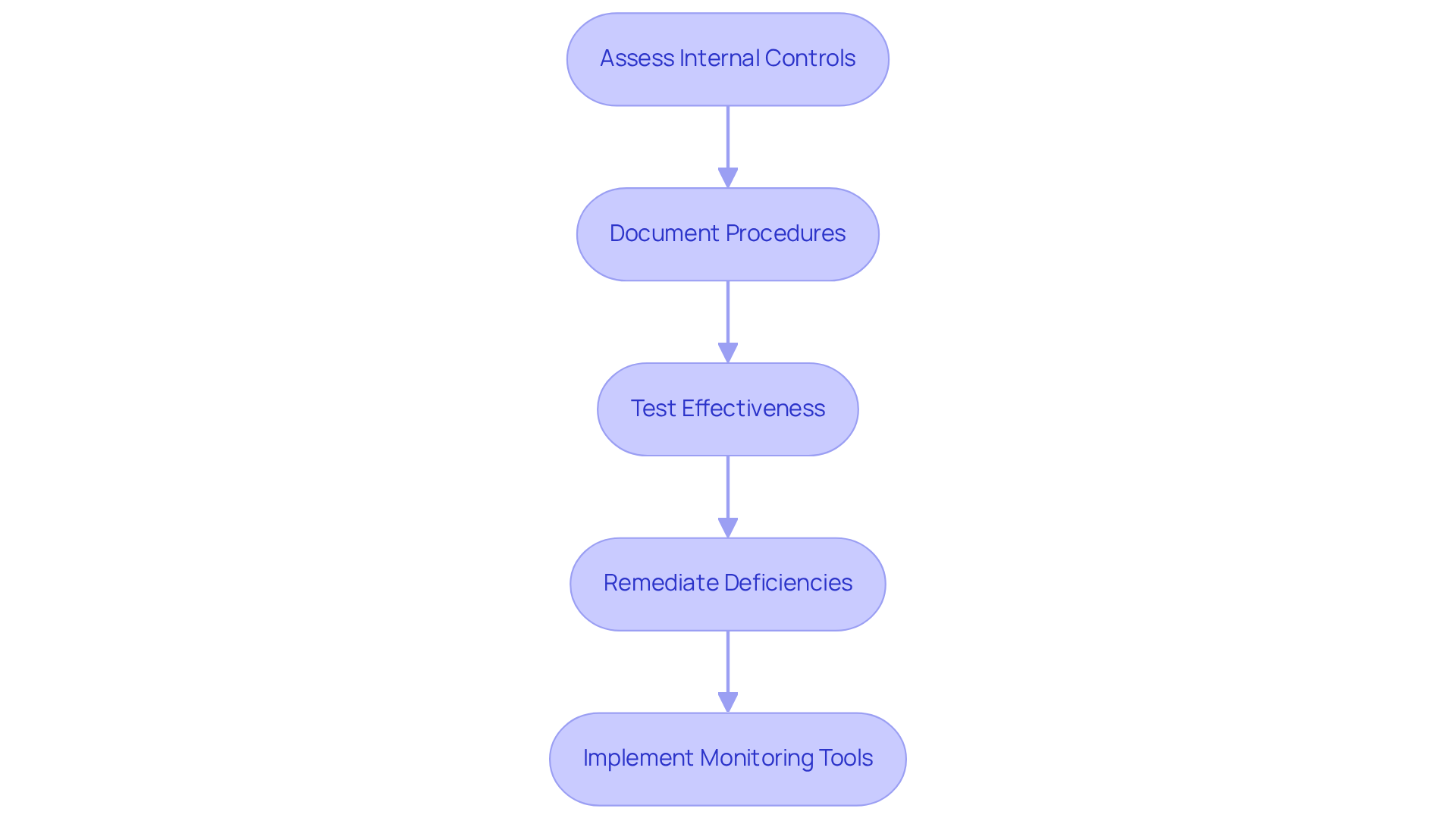

Section 404 of the Sarbanes-Oxley Act mandates that management assess and report on the effectiveness of internal mechanisms over monetary reporting within the sox compliance framework. This critical process encompasses comprehensive documentation of management procedures, rigorous testing of their effectiveness, and prompt remediation of any identified deficiencies. For defense contractors, establishing a robust internal governance structure is not just about regulatory compliance; it’s also vital for protecting sensitive monetary information and fostering trust with stakeholders.

Did you know that approximately 2.5% of both exempt and non-exempt firms experience restatements? This statistic underscores the industry's commitment to upholding high standards of integrity. Effective internal evaluations hinge on regular reviews, ongoing monitoring, and the use of automation tools, such as continuous oversight monitoring (COM) software, to enhance accuracy and efficiency. Compliance experts emphasize that implementing a sox compliance framework is essential for mitigating risks and ensuring reliable reporting.

As Michael Clements, Director at GAO, points out, "Auditor attestation does involve a significant cost increase for firms," highlighting the financial implications of compliance. By prioritizing the sox compliance framework, military contractors can not only meet compliance standards but also enhance their operational resilience.

In conclusion, the path to effective compliance is clear: invest in strong internal governance, leverage technology for monitoring, and remain vigilant in your reporting practices. This proactive approach not only safeguards your organization but also enhances stakeholder confidence.

IT General Controls (ITGCs): Ensuring Data Integrity in SOX Compliance

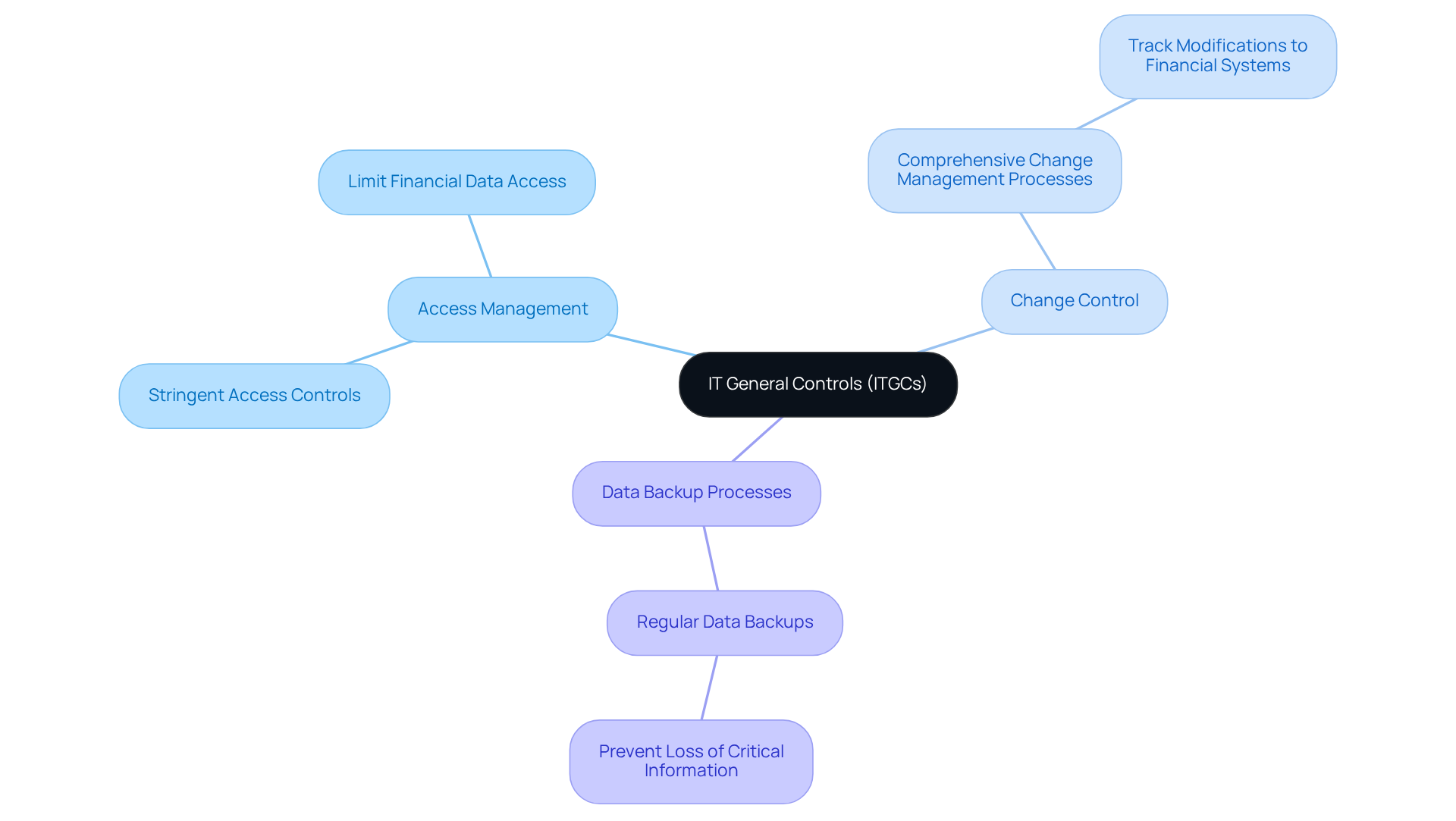

IT General Controls (ITGCs) play a crucial role in safeguarding the integrity, confidentiality, and availability of monetary data within defense contracting. These controls encompass:

- Access management

- Change control

- Data backup processes

All are vital for preventing unauthorized access and ensuring the reliability of reporting systems. As cybersecurity expert Natalie Salunke emphasizes, aligning the Chief Information Security Officer (CISO) and General Counsel (GC) on cyber risk not only enhances trust but also drives action. This underscores the necessity of robust ITGCs in financial reporting.

For contractors in the security sector, implementing effective ITGCs is more than just a regulatory requirement; it’s a strategic necessity. Regular evaluations and reviews of these measures are essential for identifying weaknesses and ensuring compliance with the SOX compliance framework. Recent trends show a growing emphasis on integrating ITGCs into broader governance frameworks, reflecting a shift in how organizations view cybersecurity as a business risk rather than merely an IT issue.

Examples of effective ITGCs in military contracting include:

- Stringent access controls that limit financial data access to authorized personnel

- Comprehensive change management processes that track modifications to financial systems

- Regular data backups to prevent the loss of critical information

These practices not only enhance data integrity but also bolster overall compliance efforts, positioning contractors to meet the stringent requirements of the SOX compliance framework while maintaining stakeholder trust.

As contractors in the security sector prepare for the upcoming CMMC adherence standards, it’s crucial that their ITGCs align with the required CMMC tiers. This proactive approach, supported by practical strategies and peer insights, is essential for navigating the evolving landscape of cybersecurity and governance. By ensuring their ITGCs are robust, contractors can confidently achieve compliance.

Fraud Risk Assessment: Identifying Vulnerabilities in SOX Compliance

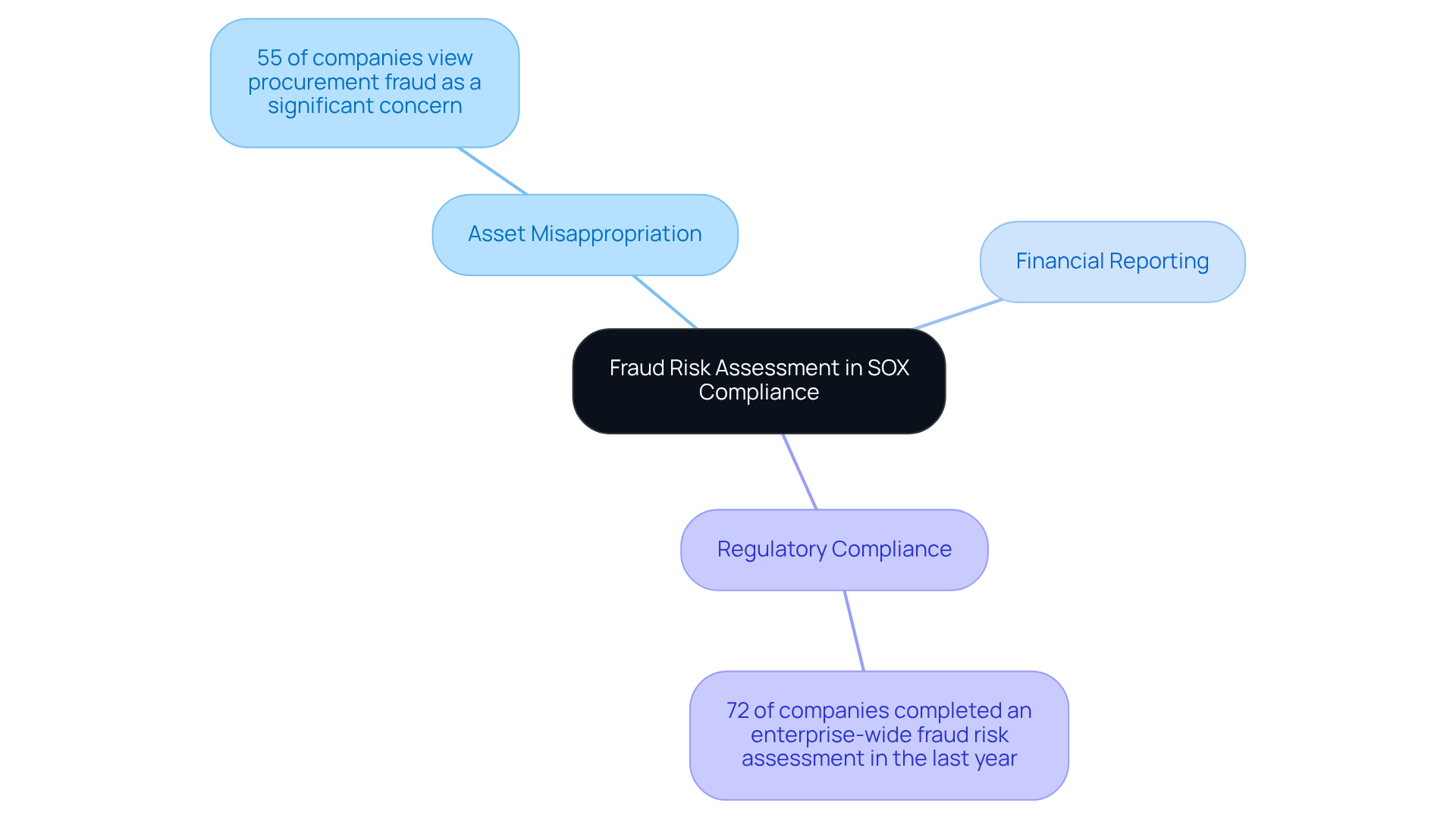

A fraud risk assessment is essential for organizations aiming to systematically identify and evaluate potential fraud risks within their operations. For defense contractors, this evaluation should focus on critical areas such as:

- Asset misappropriation

- Financial reporting

- Regulatory compliance

Did you know that 55% of companies view procurement fraud as a significant concern? This statistic underscores the necessity for vigilance in these domains. Moreover, 72% of companies have completed an enterprise-wide fraud risk assessment in the past year, highlighting the importance of regular evaluations.

By recognizing these vulnerabilities, organizations can implement robust measures that align with the SOX compliance framework, thereby enhancing their compliance posture. As regulatory specialists assert, "Identifying fraud vulnerabilities is not merely a procedural task but a fundamental aspect of fostering a culture of integrity and accountability within the organization."

It's also crucial to understand that a cyber incident can obliterate years of reputation in mere minutes, making these assessments even more vital. Regularly reviewing and updating your fraud risk assessment allows organizations to adapt to evolving risks and maintain a proactive stance against potential threats. Take action now to safeguard your organization and ensure compliance.

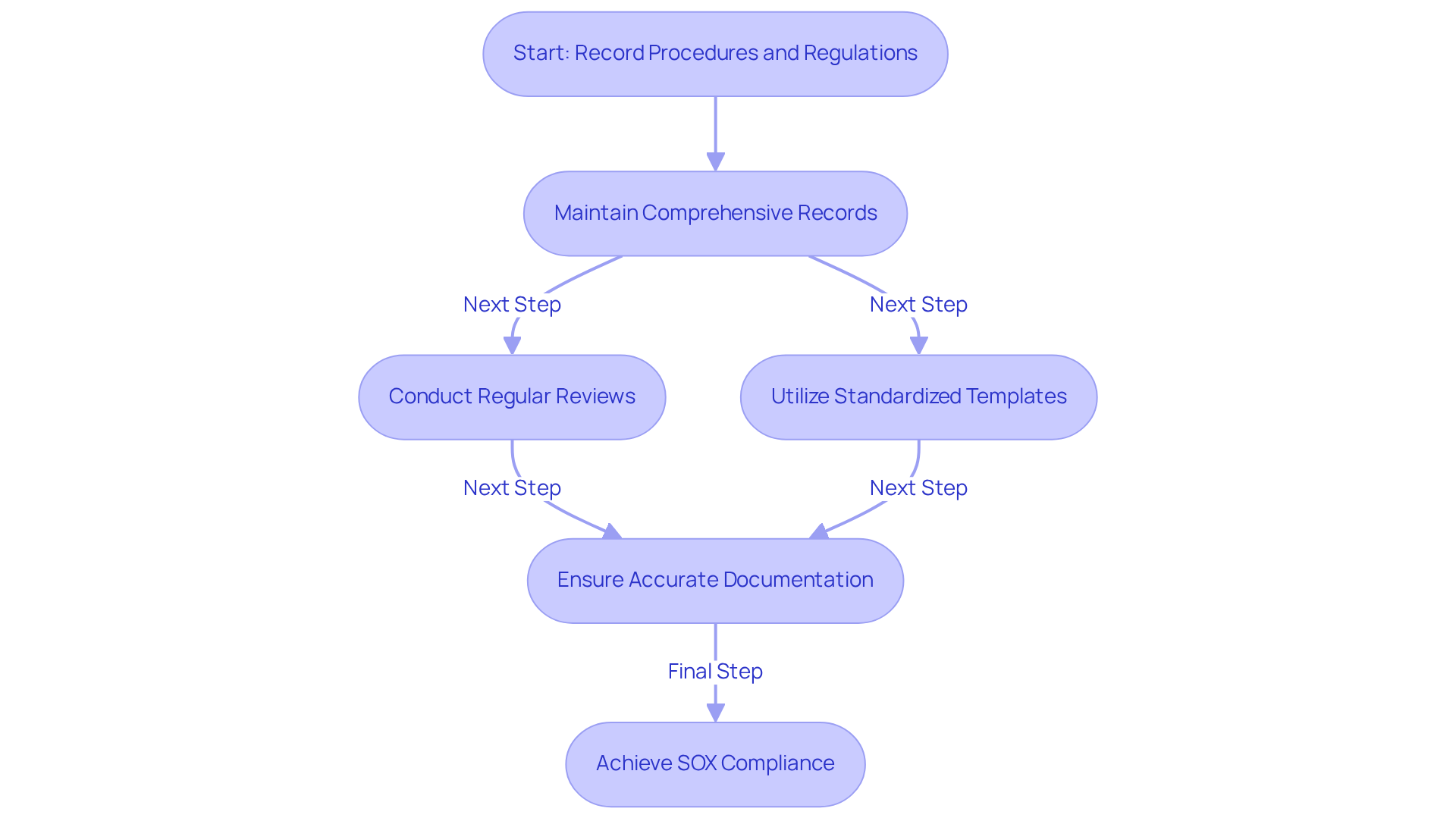

Process and Control Documentation: A Pillar of SOX Compliance

Recording procedures and regulations is essential for achieving adherence to the SOX compliance framework. Organizations must maintain comprehensive records that detail the operation of key controls, including descriptions, testing results, and any identified deficiencies. For defense contractors, this documentation not only strengthens adherence efforts but also enhances transparency and accountability in financial reporting.

Why is this important? Regular reviews and updates to documentation are crucial, ensuring accuracy and alignment with current practices. Efficient documentation methods, such as maintaining clear audit trails and utilizing standardized templates, can significantly improve success rates in meeting regulations. Auditors emphasize that thorough documentation is vital, as it provides the necessary proof of adherence and facilitates more efficient audits.

Consider this: 76% of executives have noted that the increasing complexity of regulatory demands has negatively impacted their ability to maintain third-party relationships. This makes emphasizing documentation even more critical. Furthermore, the average budget for SOX programs is reported to be $1.6 million, underscoring the financial implications of compliance efforts.

By prioritizing compliance documentation, contractors can navigate the complexities of the SOX compliance framework more effectively. This not only fosters a culture of adherence but also builds trust within the organization and with external stakeholders.

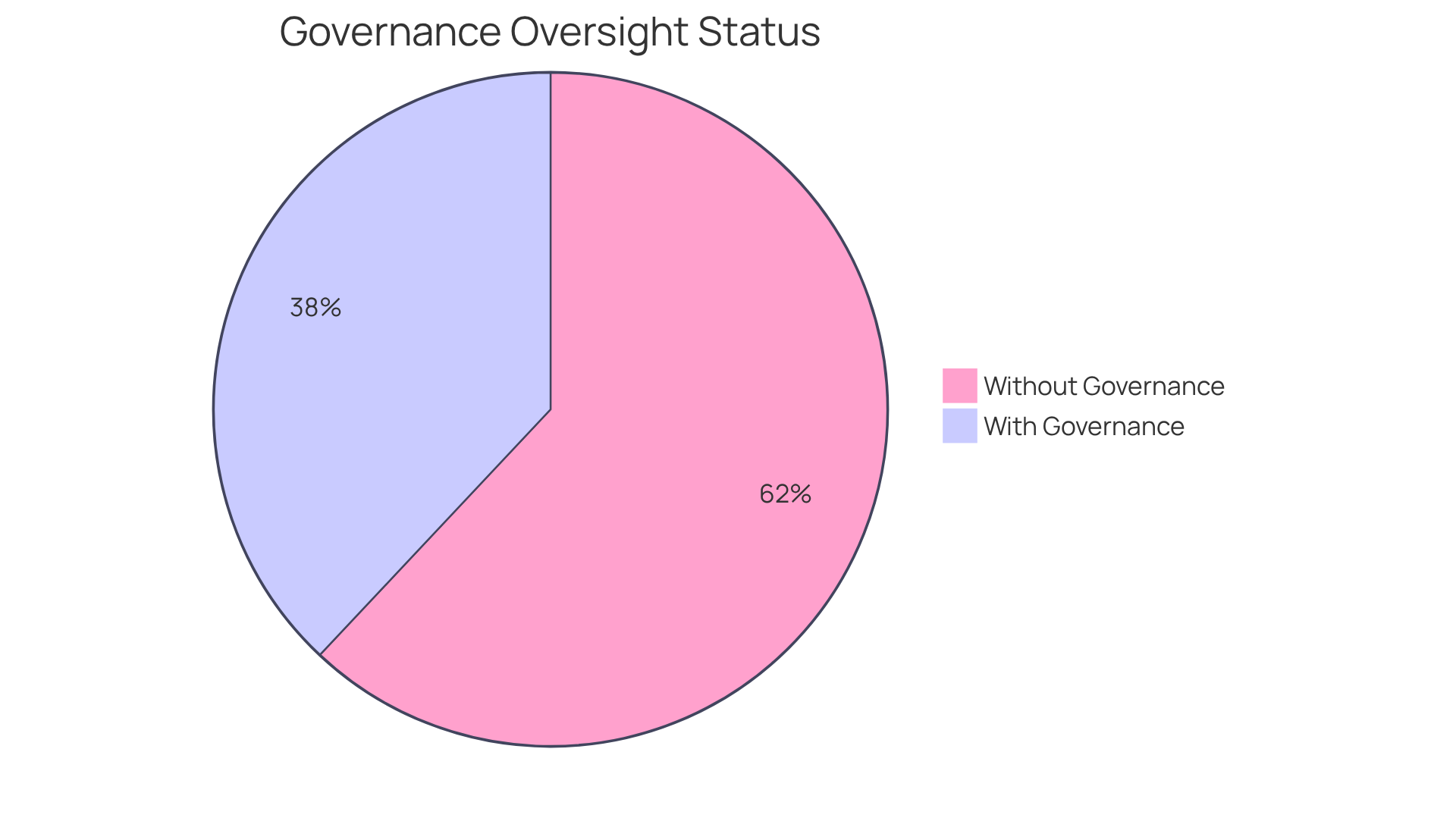

Testing Key Controls: Proactive Measures for SOX Compliance

Routine evaluation of key measures is essential for defense contractors aiming to ensure the effectiveness of their internal systems in financial reporting. This proactive approach involves assessing both the design and operational efficiency of these measures, identifying shortcomings, and implementing corrective actions. Recent data reveals that only 38% of organizations pursuing CMMC 2.0 have established comprehensive governance oversight and tracking systems. This statistic highlights a significant gap in effective testing practices. Furthermore, 62% of security contractors lack the necessary governance measures, which can lead to vulnerabilities in compliance and financial reporting.

To adhere to the SOX compliance framework and maintain the integrity of financial reporting processes, defense contractors must adopt recognized testing frameworks. These frameworks not only facilitate regular evaluations but also empower organizations to respond swiftly to any identified deficiencies. Compliance auditors emphasize that effective scrutiny testing is not merely a regulatory requirement; it is a crucial component of a robust governance strategy that enhances overall business performance. By concentrating on the assessment of internal controls, organizations can mitigate risks, improve regulatory outcomes, and foster stakeholder trust.

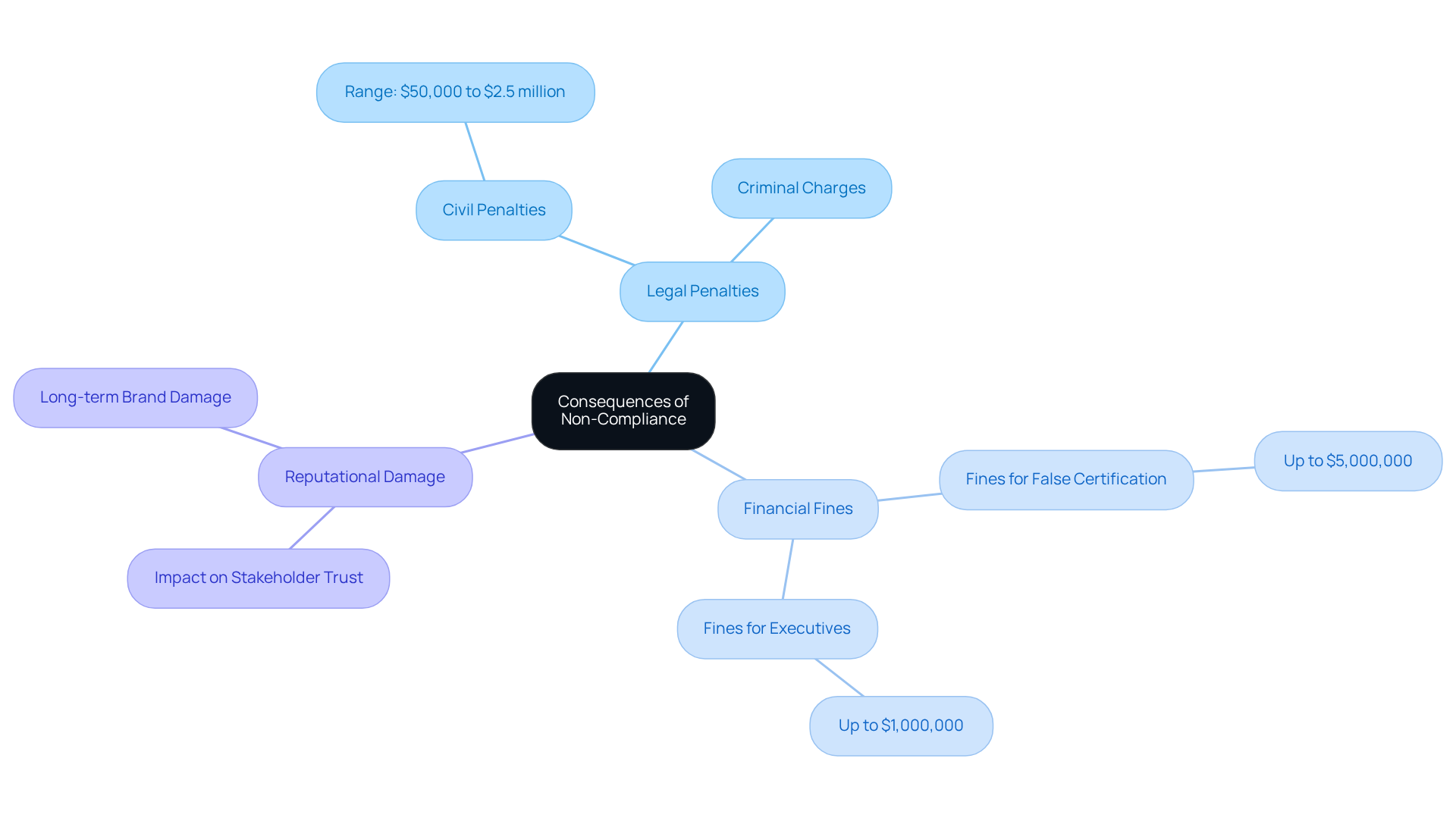

Consequences of Non-Compliance: Risks for Defense Contractors

Non-compliance with the Sarbanes-Oxley Act can lead to severe consequences for military contractors within the sox compliance framework. These consequences include:

- Legal penalties

- Financial fines

- Significant reputational damage

Organizations may face civil penalties imposed by the SEC, which can range from $50,000 to $2.5 million, depending on the severity of the violation. Furthermore, executives found guilty of non-compliance may face criminal charges, including imprisonment.

Recognizing these risks underscores the importance of upholding strong regulatory practices. Are you prepared to navigate these challenges? Ensuring compliance with the sox compliance framework not only protects your organization from penalties but also enhances your reputation in the industry. Take action now to implement robust compliance measures and safeguard your organization’s future.

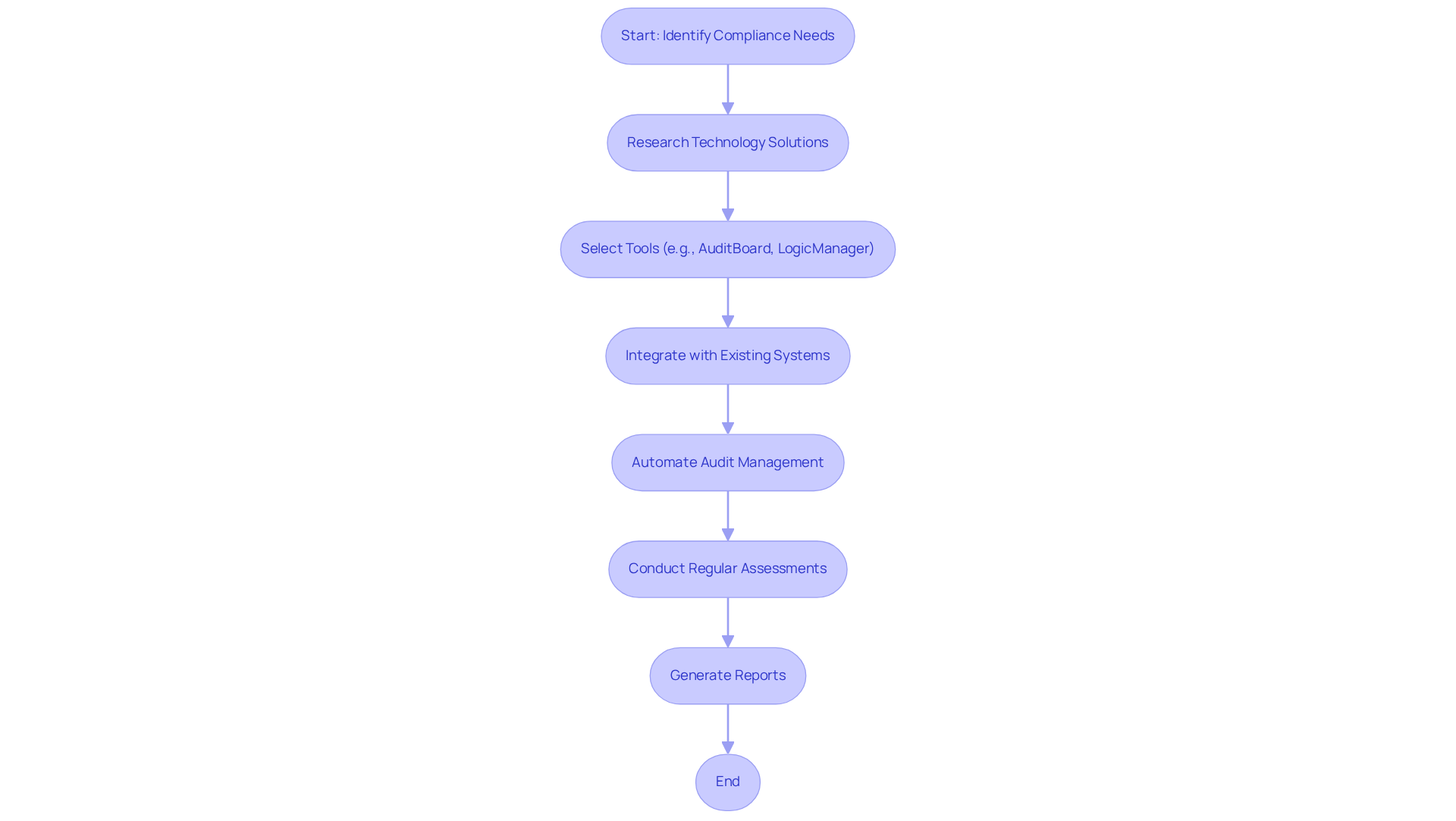

Technology Solutions: Streamlining SOX Compliance for Defense Contractors

Technology solutions play a vital role in optimizing the sox compliance framework for defense contractors. Just as outlined in the Ultimate Guide to Achieving CMMC Conformity, these solutions streamline compliance efforts. Automated tools for audit management, risk evaluation, and oversight monitoring significantly reduce the manual workload associated with regulatory activities.

By implementing software solutions that seamlessly integrate with existing systems, organizations can ensure accurate record-keeping, conduct regular assessments, and generate reports with ease. This technological leverage not only enhances regulatory compliance but also minimizes the risk of errors and oversights. Ultimately, it fosters a more efficient regulatory environment.

As industry leaders emphasize, automating regulatory processes transcends mere efficiency; it establishes a robust framework that upholds organizational integrity and accountability. Consider tools like AuditBoard and LogicManager, which have been recognized for their effectiveness in managing the sox compliance framework within the military sector. These tools address the unique challenges faced by contractors, echoing the practical strategies highlighted for achieving CMMC compliance.

Are you ready to elevate your compliance efforts? Embracing these technological solutions can significantly enhance your organization’s regulatory stance.

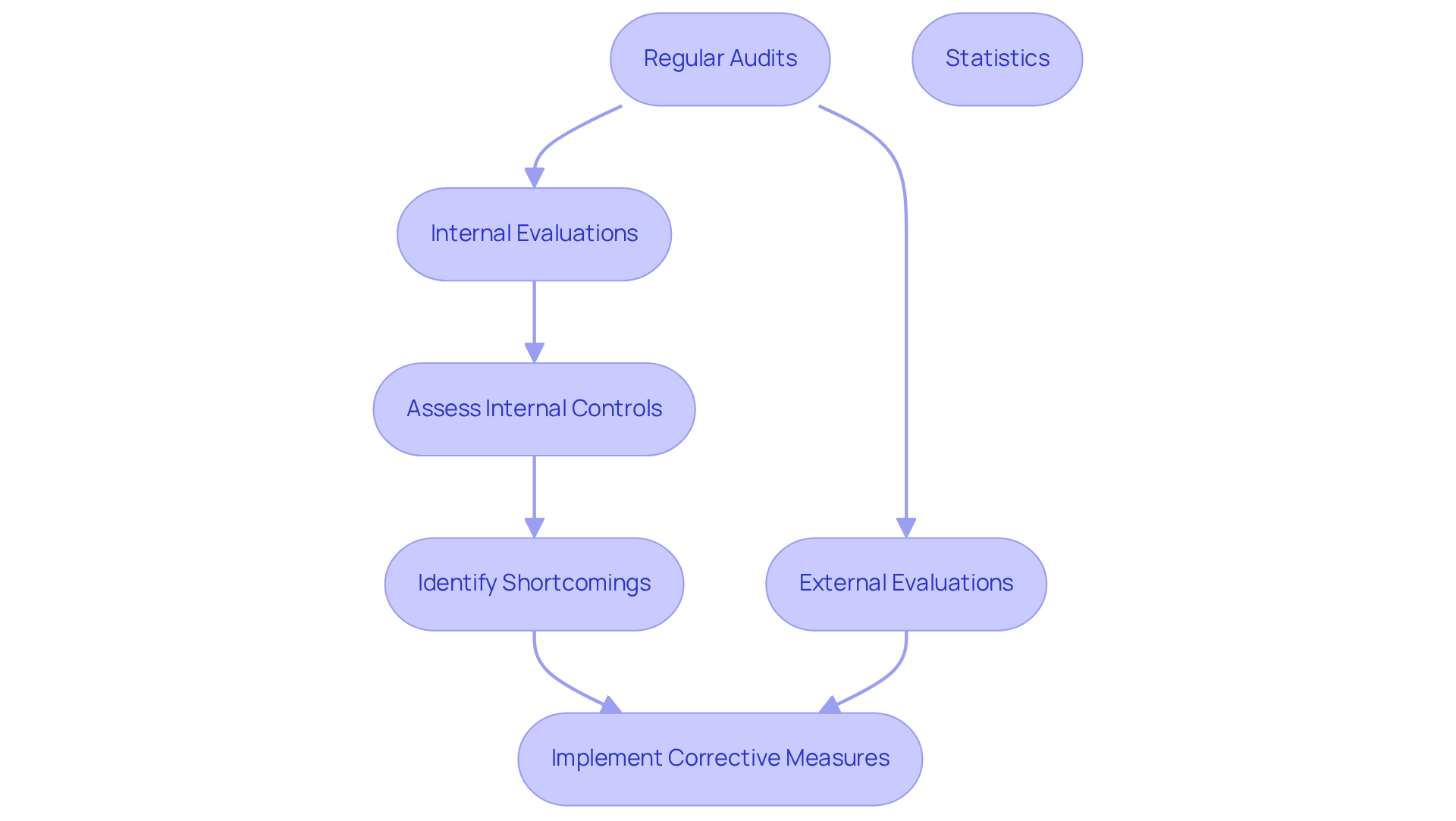

Regular Audits: Maintaining SOX Compliance for Defense Contractors

Regular audits are crucial for defense contractors aiming to uphold the SOX compliance framework. These audits must include both internal and external evaluations to thoroughly assess the effectiveness of internal controls and adherence processes. By identifying shortcomings and areas for improvement, organizations can implement corrective measures that bolster their regulatory position. In fact, 58% of organizations conducted four or more audits in 2025, underscoring their commitment to stringent regulatory practices.

Not only do regular audits ensure compliance with the SOX compliance framework, but they also promote a culture of accountability and continuous improvement within the organization. For example, recent findings from the Defense Contract Audit Agency (DCAA) revealed $15.9 billion in audit exceptions in FY24, emphasizing the urgent need for robust audit practices. Furthermore, 71% of executives expect to engage in digital transformation initiatives that require regulatory support, indicating that effective audit practices are vital for navigating the evolving regulatory landscape.

As one auditor pointed out, maintaining compliance through regular assessments is not merely a best practice; it is a strategic imperative for success in defense contracting. Are you ready to strengthen your organization's compliance efforts? Embrace regular audits as a key component of your strategy.

Conclusion

The SOX compliance framework stands as a critical pillar for defense contractors, ensuring adherence to stringent regulatory standards while fostering trust and transparency in financial practices. How can organizations effectively navigate the complexities of the Sarbanes-Oxley Act? By understanding and implementing the key elements outlined in this article, they can enhance their operational integrity and compliance posture.

Key strategies such as:

- Establishing robust internal controls

- Conducting regular audits

- Leveraging technology solutions

are essential. These practices not only mitigate risks associated with non-compliance but also cultivate a culture of accountability and ethical conduct within organizations. Furthermore, the significance of documentation, fraud risk assessments, and IT general controls highlights the multifaceted approach necessary for successful SOX adherence.

In light of the evolving regulatory landscape, it is imperative for defense contractors to prioritize SOX compliance as a strategic initiative. By taking proactive measures and investing in comprehensive compliance strategies, organizations can safeguard their reputation, avoid severe penalties, and secure their position in the competitive defense industry. Embracing these principles not only ensures compliance but also enhances overall business performance, paving the way for sustainable growth and stakeholder confidence.

Frequently Asked Questions

What is the purpose of the CMMC Info Hub?

The CMMC Info Hub serves as a resource for defense contractors to understand and implement the SOX compliance framework related to the Sarbanes-Oxley Act (SOX) adherence requirements.

Why is SOX compliance important for defense contractors?

SOX compliance is crucial for defense contractors as it ensures they align their operations with stringent regulatory standards set by the Department of Defense (DoD), enhancing financial practices and obligations when engaging with government contracts.

What are some effective strategies for SOX adherence for contractors?

Effective SOX adherence strategies include establishing robust internal measures, conducting frequent audits, and implementing proactive risk management practices.

What are the key provisions of the Sarbanes-Oxley Act?

Key provisions of the Sarbanes-Oxley Act include the establishment of robust internal oversight, strict reporting requirements, and the formation of independent audit committees.

What financial commitment do companies need to make for SOX compliance?

Companies are often required to allocate substantial budgets, typically exceeding $1-2 million annually, to meet SOX regulatory standards.

What responsibilities do executives have under the Sarbanes-Oxley Act?

Executives, particularly CEOs and CFOs, are mandated to verify the accuracy of reports and the effectiveness of internal controls within 90 days of submission.

How does Section 404 of SOX impact management assessment?

Section 404 mandates that management assess and report on the effectiveness of internal mechanisms over monetary reporting, requiring comprehensive documentation, rigorous testing, and prompt remediation of deficiencies.

What role does technology play in SOX compliance?

Technology, such as continuous oversight monitoring (COM) software, enhances accuracy and efficiency in internal evaluations and reporting practices for SOX compliance.

What are the consequences of non-compliance with SOX?

Non-compliance with SOX can lead to severe penalties, including criminal charges for executives who certify false reports.

How does SOX compliance affect transparency and accountability in reporting?

The SOX compliance framework drives enhanced disclosure requirements and the need for regular audits, fostering improved transparency and accountability in financial reporting.