4 Steps to Navigate New York State Cybersecurity Compliance

Navigate New York State cybersecurity compliance with essential steps for your organization.

Introduction

Navigating the complex landscape of cybersecurity compliance in New York State presents a significant challenge for many organizations. With the NYDFS Cybersecurity Regulation imposing stringent requirements, understanding the nuances of compliance is not merely beneficial; it is essential for safeguarding sensitive information.

What specific steps must organizations take to ensure they meet these regulations? How can they effectively manage potential exemptions?

This guide provides a clear path to achieving compliance, addressing critical questions that may arise along the way.

Determine Applicability of NYDFS Cybersecurity Regulation

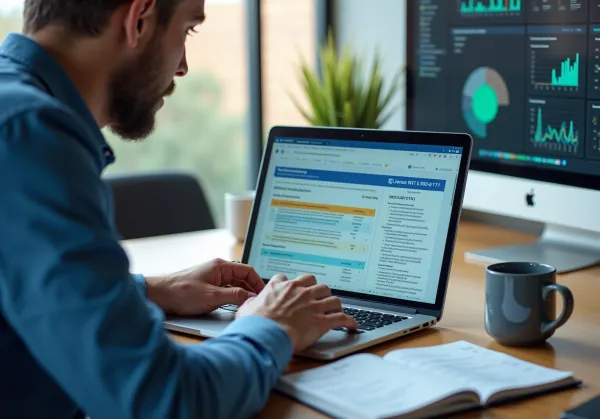

To determine if your organization falls under the NYDFS Cybersecurity Regulation, follow these essential steps:

-

Identify Your Business Type: First, confirm whether your organization qualifies as a financial institution, insurance company, or any entity regulated by the New York Department of Financial Services. Covered Entities include banks, insurance companies, mortgage brokers, and virtual currency businesses.

-

Review Revenue and Employee Thresholds: Next, assess your organization's size. Those with fewer than 20 employees and less than $7.5 million in gross annual revenue may qualify for limited exemptions under Section 500.19. Specifically, organizations with fewer than 10 employees or less than $5 million in revenue over the last three years are often exempt from certain requirements.

-

Consult the New York State Cybersecurity Guidelines: For detailed criteria and examples of covered entities, refer to the New York State Cybersecurity Resource Center. This invaluable resource outlines the specific obligations and adherence expectations for various business types.

-

Document Your Findings: Finally, keep a detailed record of your evaluation. This documentation is crucial for supporting future adherence efforts and audits. It demonstrates compliance during regulatory reviews and can significantly reduce risks associated with nonadherence.

As of November 1, 2025, the Cybersecurity Regulation from the New York State Cybersecurity Department of Financial Services mandates universal Multi-Factor Authentication (MFA) for nearly all Covered Entities. This underscores the importance of understanding your entity's classification and compliance responsibilities. Recent statistics reveal that a substantial percentage of businesses may qualify for exemptions based on employee count, emphasizing the necessity for a thorough evaluation.

Identify and Notify Exemptions Under the Regulation

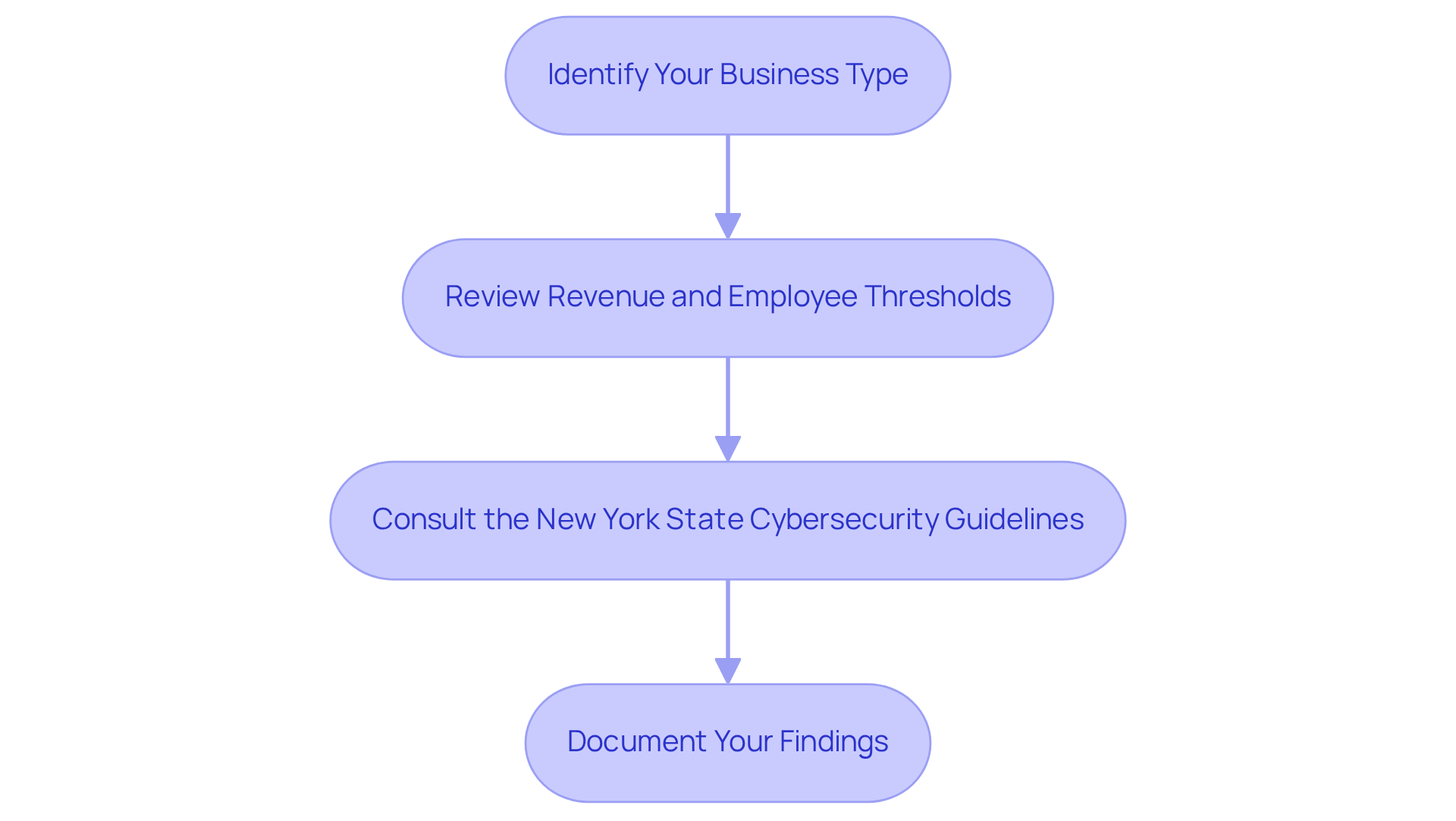

To navigate the NYDFS exemption process effectively, organizations should follow these essential steps:

-

Determine Eligibility: Verify that your organization qualifies for an exemption. Typically, this includes criteria such as having fewer than 20 employees or less than $7.5 million in gross annual revenue.

-

Prepare Documentation: Compile the necessary documentation to substantiate your exemption claim. This includes financial statements, employee counts, and any other relevant records that demonstrate compliance with exemption criteria.

-

Submit a Notice of Exemption: File a Notice of Exemption with the relevant authority within 30 days of confirming your eligibility. Ensure that you follow the specific filing instructions given by the New York Department of Financial Services for compliance with New York State cybersecurity to avoid delays.

-

Maintain Records: Retain copies of your exemption notice and all supporting documents for at least five years. This is crucial for future compliance audits and to demonstrate your adherence to regulatory requirements.

Organizations should be aware that the average processing time for exemption notices can vary. However, timely and precise submissions can facilitate a smoother review process. Legal experts emphasize that thorough documentation is key to successfully navigating the exemption criteria, as it provides the necessary evidence to support your claim.

Are you ready to take the necessary steps towards compliance? By following these guidelines, you can ensure that your organization is well-prepared for the NYDFS exemption process.

Assess Applicable Sections of the Cybersecurity Regulation

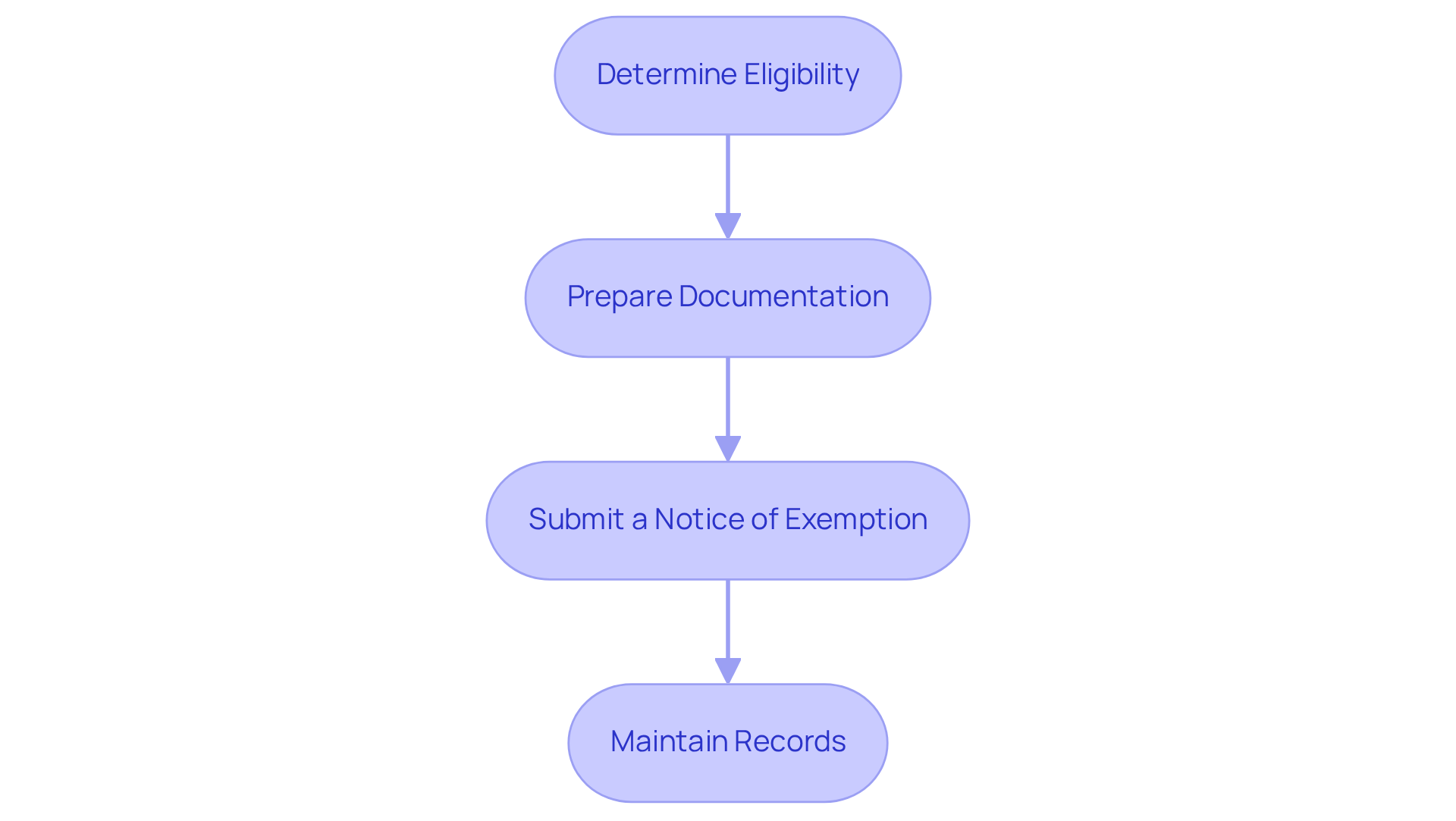

To determine which sections of the NYDFS Cybersecurity Regulation apply to your organization, follow these essential steps:

-

Review the Regulation: Begin by thoroughly familiarizing yourself with the New York State cybersecurity regulation (23 NYCRR Part 500). Grasping its structure and requirements is essential for effective adherence.

-

Identify Relevant Sections: Focus on sections that directly relate to your organization's operations. Key areas include risk assessments, security policies, and incident response plans, which are essential to maintaining compliance.

-

Conduct a Gap Analysis: Perform a comprehensive comparison of your current cybersecurity practices against the requirements specified in the relevant sections. This analysis will assist in identifying areas that need improvement, ensuring your entity meets the regulatory standards.

-

Document Your Assessment: Maintain detailed records of your findings, including the specific sections that apply to your organization. This documentation is essential for clarity in your adherence efforts and will serve as a reference for future evaluations.

Statistics indicate that 95% of cybersecurity incidents at small and medium-sized businesses (SMBs) can cost between $826 and $653,587. This underscores the importance of robust cybersecurity practices. Moreover, entities that proactively perform gap analyses are better equipped to handle regulatory challenges efficiently. Furthermore, as of November 1, 2025, all Covered Entities must implement Multi-Factor Authentication (MFA) for individuals accessing their information systems, which is a vital regulatory requirement. By following these steps, your entity can improve its security stance and ensure alignment with New York State cybersecurity regulations, including the requirement to submit an annual notice regarding adherence to Part 500 by April 15.

Implement Required Compliance Measures

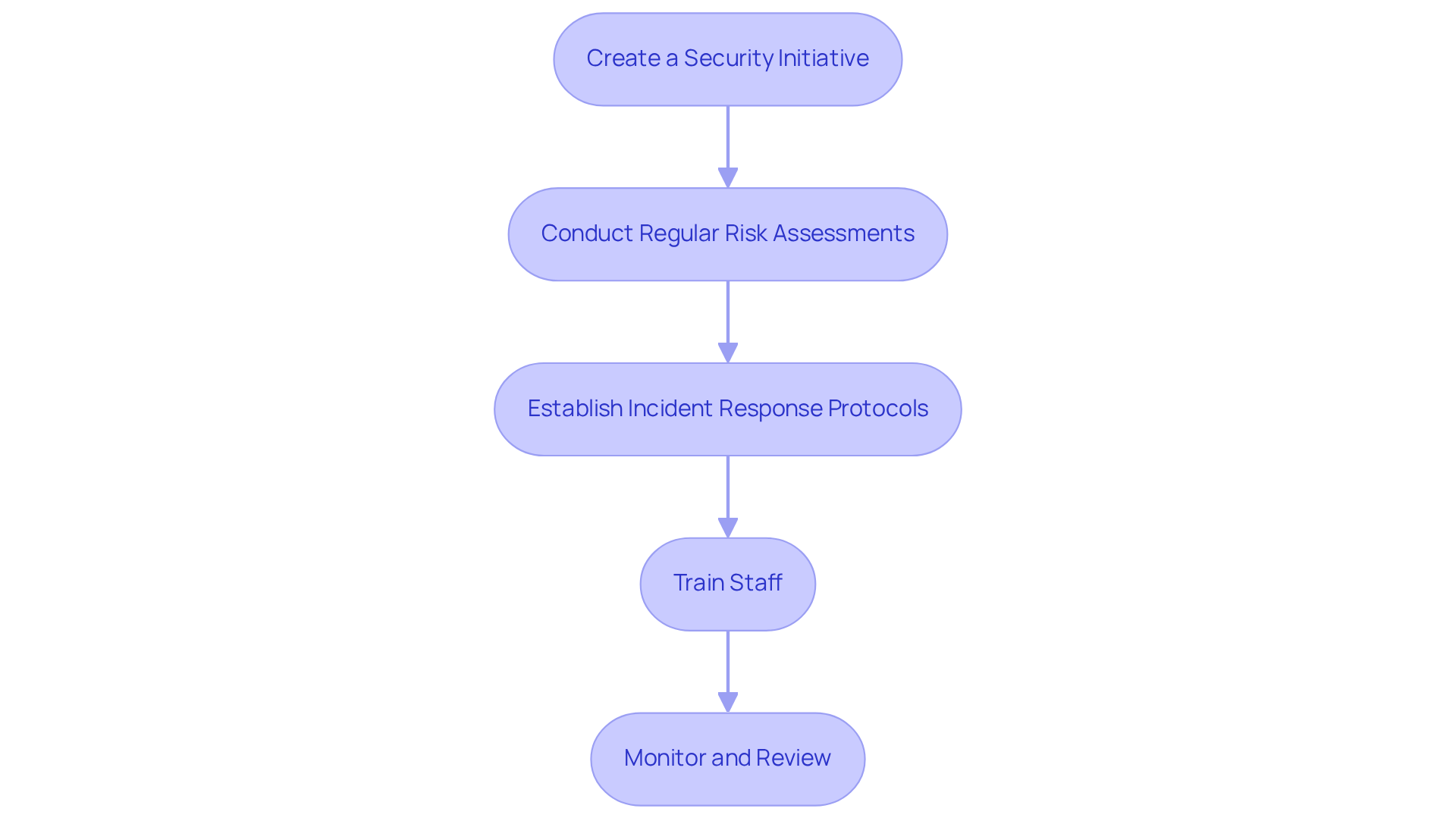

To implement the required compliance measures, follow these steps:

-

Create a Security Initiative: Establish a comprehensive security initiative that encompasses policies, procedures, and controls tailored specifically for your organization. This program must align with the New York State cybersecurity regulations, which require ongoing evaluation and adaptation to address evolving risks. Are your current measures robust enough to meet these demands?

-

Conduct Regular Risk Assessments: Regularly perform risk assessments to pinpoint vulnerabilities within your systems. Notably, around 52% of entities report that they incorporate compliance into their risk evaluations. This highlights the critical nature of this practice in ensuring the effectiveness of your security measures.

-

Establish Incident Response Protocols: Develop and document incident response plans that detail how to swiftly and effectively tackle potential security events. This proactive strategy is essential, as organizations must notify the New York State cybersecurity department of any security incidents within 72 hours of detection. Are your protocols ready to handle such situations?

-

Train Staff: Implement training initiatives for all staff on digital security best practices and the importance of adhering to NYDFS regulations. Regular training not only enhances awareness but also prepares your team to mitigate risks associated with human error. How prepared is your staff to handle security challenges?

-

Monitor and Review: Continuously monitor your cybersecurity measures and conduct regular reviews to adapt to new threats and regulatory changes. This ongoing vigilance is crucial, especially considering that 68% of organizations still rely on spreadsheets and word-processing applications to manage compliance. Isn’t it time to consider more robust monitoring solutions?

Conclusion

Navigating the complexities of New York State's cybersecurity compliance can be daunting, but it’s essential for organizations operating within its jurisdiction. Understanding the NYDFS Cybersecurity Regulation and determining your organization's applicability is the first step toward ensuring compliance. By following the outlined processes, businesses can effectively identify their responsibilities and take proactive measures to align with regulatory requirements.

This article details a comprehensive four-step approach:

- Determine Applicability: Assess whether your organization falls under the regulation.

- Identify Exemptions: Understand any exemptions that may apply to your situation.

- Assess Relevant Sections: Review the specific sections of the regulation that impact your operations.

- Implement Compliance Measures: Take necessary actions to meet compliance standards.

Each step emphasizes the importance of documentation, regular assessments, and staff training, all of which contribute to a robust cybersecurity framework. The necessity for Multi-Factor Authentication by November 2025 further highlights the urgency of these actions, ensuring that organizations are not only compliant but also prepared for evolving cybersecurity threats.

Ultimately, prioritizing cybersecurity compliance is not just a regulatory obligation; it’s a critical component of organizational resilience. By taking these steps, businesses can safeguard their operations, protect sensitive information, and foster trust with clients and stakeholders. Embracing these practices not only enhances compliance but also positions organizations to thrive in a landscape where cybersecurity is paramount.

Frequently Asked Questions

What is the NYDFS Cybersecurity Regulation?

The NYDFS Cybersecurity Regulation is a set of requirements established by the New York Department of Financial Services aimed at enhancing cybersecurity measures for financial institutions and other regulated entities.

How can an organization determine if it falls under the NYDFS Cybersecurity Regulation?

Organizations can determine applicability by identifying their business type, reviewing revenue and employee thresholds, consulting the New York State Cybersecurity Guidelines, and documenting their findings.

What types of organizations are considered Covered Entities under the NYDFS Cybersecurity Regulation?

Covered Entities include financial institutions, insurance companies, mortgage brokers, and virtual currency businesses regulated by the New York Department of Financial Services.

Are there any exemptions for smaller organizations under the NYDFS Cybersecurity Regulation?

Yes, organizations with fewer than 20 employees and less than $7.5 million in gross annual revenue may qualify for limited exemptions. Specifically, those with fewer than 10 employees or less than $5 million in revenue over the last three years are often exempt from certain requirements.

Where can organizations find detailed criteria and examples of Covered Entities?

Organizations can refer to the New York State Cybersecurity Resource Center for detailed criteria, examples of covered entities, and specific obligations related to compliance.

Why is it important to document the evaluation of compliance with the NYDFS Cybersecurity Regulation?

Documenting the evaluation is crucial for supporting future adherence efforts, audits, and demonstrating compliance during regulatory reviews. It can also help reduce risks associated with nonadherence.

What is the significance of the Multi-Factor Authentication (MFA) requirement in the NYDFS Cybersecurity Regulation?

As of November 1, 2025, the Cybersecurity Regulation mandates universal Multi-Factor Authentication for nearly all Covered Entities, highlighting the importance of understanding compliance responsibilities and entity classification.

What recent statistics indicate about businesses and exemptions under the NYDFS Cybersecurity Regulation?

Recent statistics reveal that a substantial percentage of businesses may qualify for exemptions based on employee count, emphasizing the necessity for a thorough evaluation of compliance requirements.