5 Best Practices for Fintech Risk and Compliance in Defense Contracts

Explore best practices for managing fintech risk and compliance in defense contracts effectively.

Introduction

In the complex realm of defense contracting, fintech compliance stands as more than just a regulatory requirement - it's a vital element that can dictate an organization's success. As financial technology increasingly intersects with national security, grasping the intricacies of compliance and risk management becomes essential for any entity aiming to excel in this sector.

But here's the challenge: how can organizations effectively navigate the intricate landscape of regulations while protecting sensitive information and ensuring operational resilience?

This article explores best practices for fintech risk and compliance in defense contracts, providing insights that empower organizations to bolster their cybersecurity posture and secure a competitive advantage.

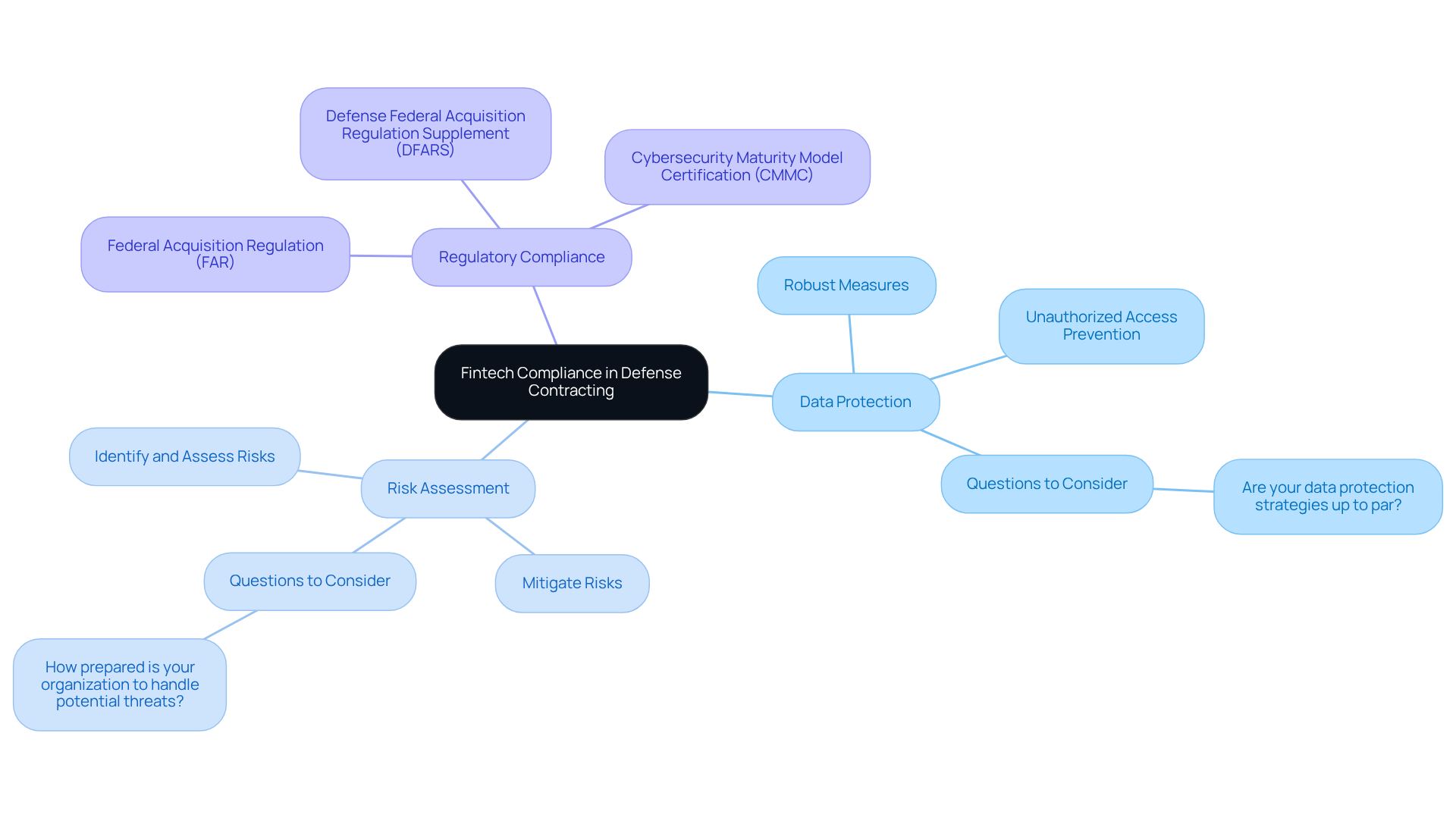

Define Fintech Compliance in Defense Contracting

The fintech risk and compliance in defense contracting demands strict adherence to the regulatory standards and frameworks that govern financial technology operations within the defense sector. At the heart of this compliance is the Cybersecurity Maturity Model Certification (CMMC), which lays out essential cybersecurity practices aimed at protecting sensitive information. Organizations must prioritize the security, transparency, and resilience of their financial systems to withstand rigorous audits and assessments.

Key components of fintech compliance include:

- Data Protection: Organizations must implement robust measures to shield sensitive data from unauthorized access and breaches. Are your data protection strategies up to par?

- It’s crucial to identify, assess, and mitigate fintech risk and compliance associated with financial operations in a security context. How prepared is your organization to handle potential threats?

- Compliance with federal regulations such as the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS) is non-negotiable for ensuring fintech risk and compliance.

By clearly defining these regulatory parameters, organizations can effectively align their operations with the expectations of the Department of Defense (DoD). This alignment not only enhances their cybersecurity posture but also positions them favorably in the competitive contracting landscape, where compliance is increasingly tied to contract eligibility and operational success. Are you ready to take the necessary steps towards compliance?

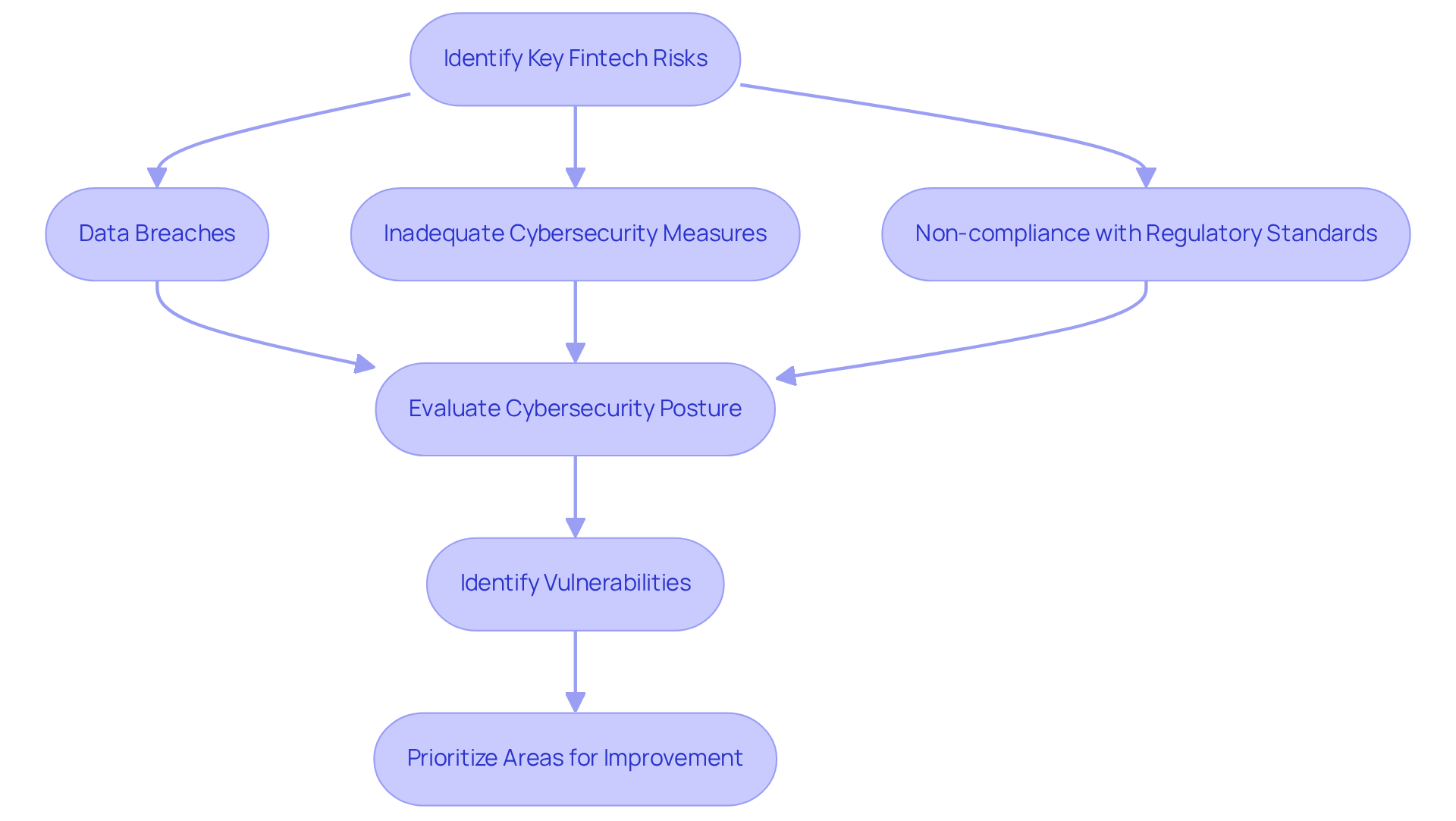

Identify Key Fintech Risks in Defense Contracts

Key fintech risk and compliance factors in defense contracts encompass:

- Data breaches

- Inadequate cybersecurity measures

- Non-compliance with regulatory standards

Organizations must remain vigilant against the potential for cyberattacks targeting financial data. Have you considered the risks associated with third-party vendors who may not meet compliance standards? Furthermore, the complexity of regulatory demands related to fintech risk and compliance can lead to inadvertent non-compliance if entities lack a comprehensive understanding of the framework.

To effectively identify these risks, entities should conduct thorough risk assessments. This involves:

- Evaluating their current cybersecurity posture

- Identifying vulnerabilities

- Prioritizing areas for improvement

By taking these proactive steps, organizations can enhance their defenses and ensure fintech risk and compliance with necessary regulations. Remember, the responsibility for safeguarding sensitive information lies with you.

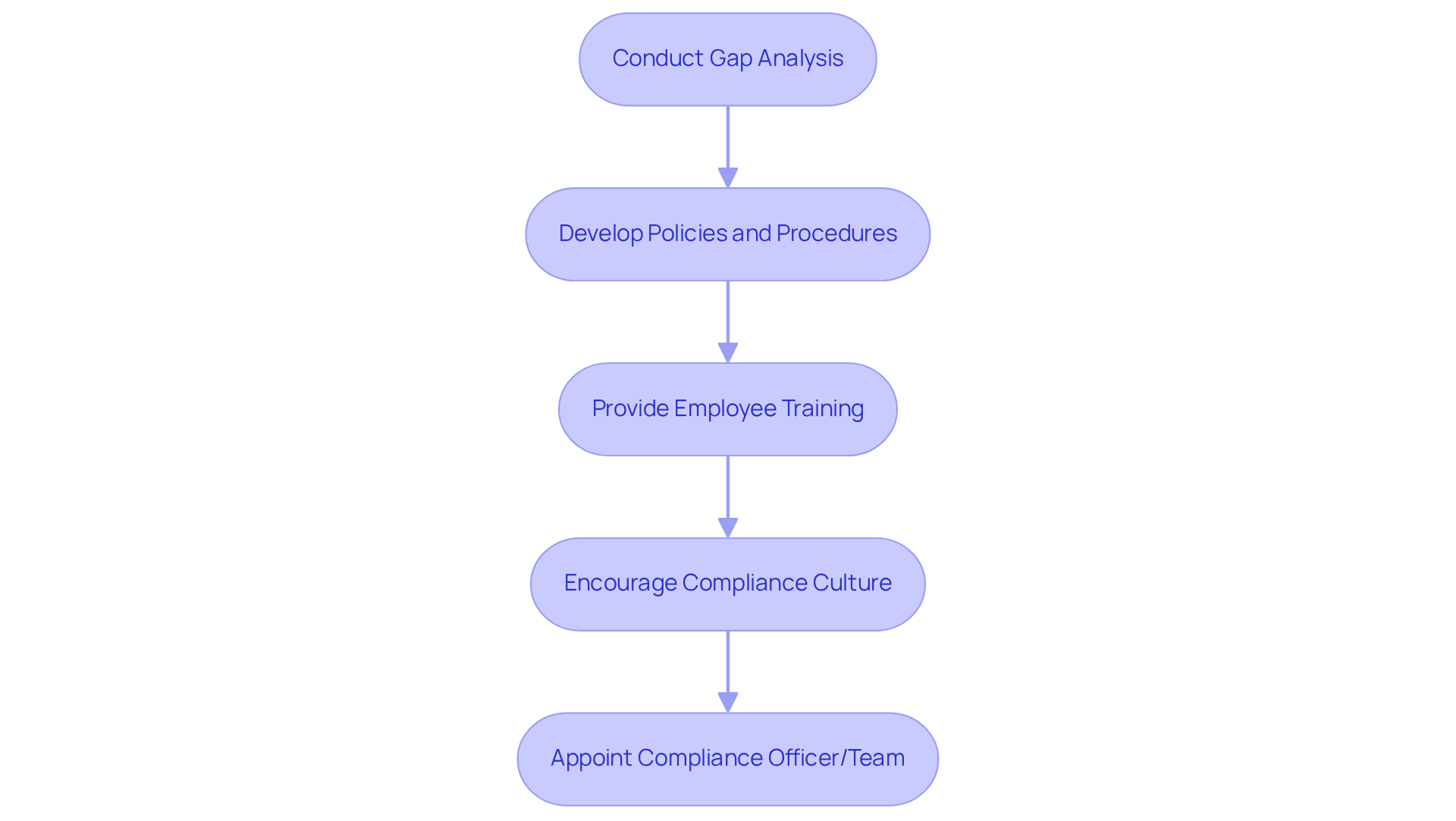

Develop a Tailored Fintech Compliance Program

To establish a successful fintech regulatory program, entities must start with a thorough gap analysis that assesses their current adherence status against CMMC requirements. Why is this analysis crucial? It pinpoints specific areas needing improvement, setting the stage for effective compliance.

Once the gaps are identified, organizations should develop clear policies and procedures to address these issues. Comprehensive training on regulatory protocols is essential for all employees, ensuring everyone is on the same page. But it doesn’t stop there; incorporating adherence into the organizational culture is vital. Regular training sessions and updates on regulatory changes can foster this culture of compliance.

Moreover, appointing a dedicated compliance officer or team is essential for overseeing the implementation and ongoing maintenance of the compliance program. This role ensures sustained adherence to established standards. Notably, organizations that have successfully implemented gap analysis have reported significant improvements in their compliance readiness. This highlights the effectiveness of gap analysis as a strategic tool in navigating the complexities of CMMC compliance.

To enhance clarity and practical application, organizations can follow these steps:

- Conduct a comprehensive gap analysis.

- Develop and implement clear policies and procedures.

- Provide thorough training for all employees.

- Encourage a culture of adherence through regular updates.

- Appoint a dedicated regulatory officer or team.

It's also important to recognize the observed readiness gaps between larger companies and smaller organizations regarding CMMC compliance preparation. For instance, larger companies often have more resources to allocate to regulatory efforts, leading to quicker execution of essential policies. By addressing these gaps and utilizing insights from gap analysis, entities can enhance their regulatory stance and better position themselves in the defense contracting environment. Practical strategies and peer insights can further support organizations in achieving regulatory adherence with confidence.

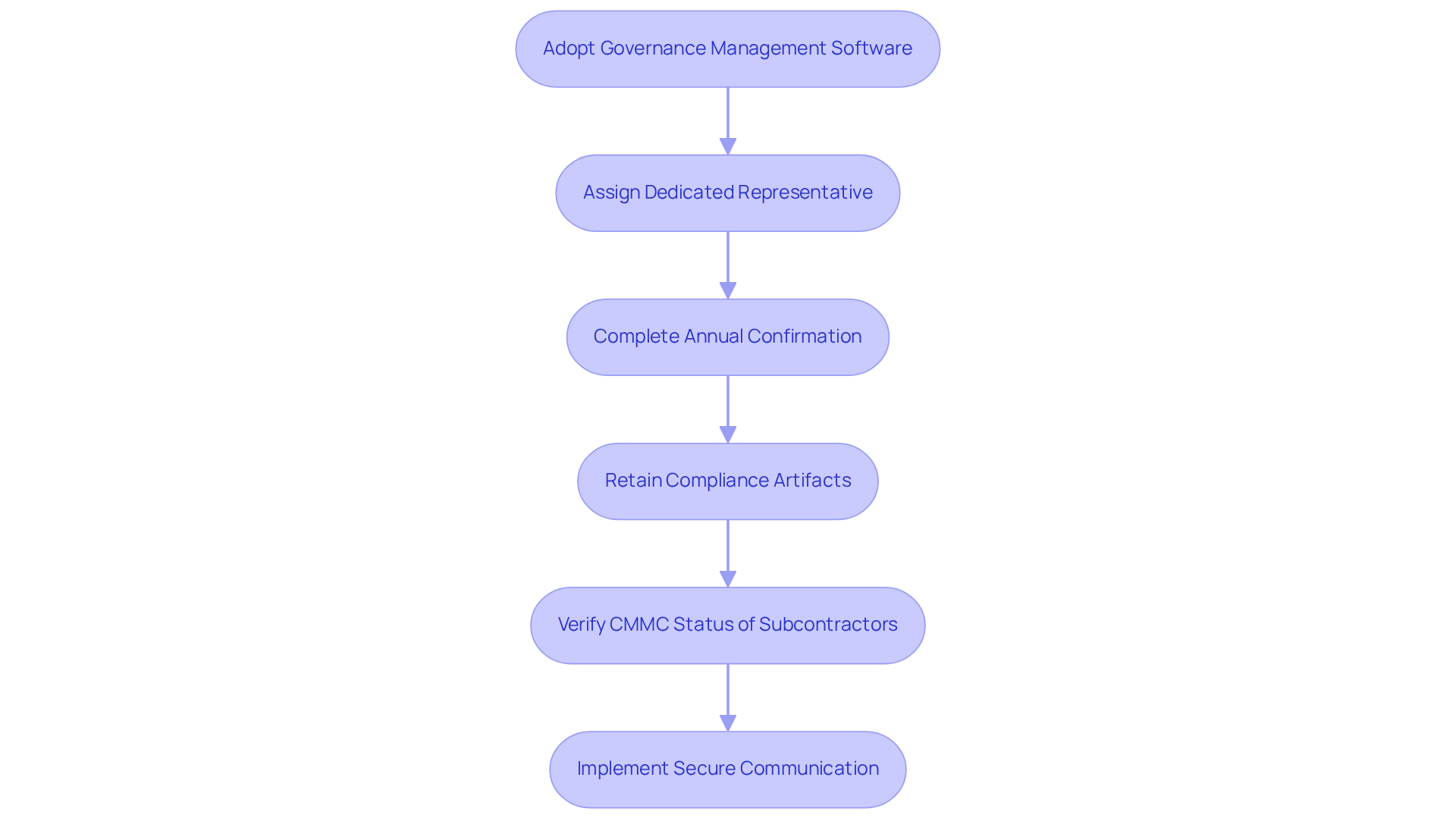

Leverage Technology for Enhanced Compliance Management

Organizations can significantly enhance their adherence management by adopting governance management software that automates essential functions like tracking, reporting, and documentation. These tools, such as risk evaluation platforms and cybersecurity frameworks, are crucial for identifying vulnerabilities and ensuring fintech risk and compliance with relevant standards. For instance, software solutions like RSA Archer and LogicGate provide extensive frameworks tailored for defense contractors, enabling them to effectively manage regulatory requirements.

But what does this mean for your organization? It’s essential to have a dedicated representative within the contractor's organization to complete an annual confirmation of ongoing conformity for each UID. This step ensures continuous alignment with standards. Additionally, retaining compliance artifacts for at least six years after submitting CMMC assessment results is vital for demonstrating compliance obligations.

Prime contractors must also verify the current CMMC status of subcontractors before awarding contracts, impacting the entire supply chain. Implementing secure communication channels and robust data encryption technologies is essential for safeguarding sensitive information against unauthorized access. Regular updates to these technologies, along with systematic audits, will ensure that adherence measures remain effective and aligned with the ever-evolving regulatory landscape.

By utilizing these advanced tools, companies can simplify their regulatory processes for fintech risk and compliance while enhancing their overall cybersecurity posture. This positions them advantageously for defense contracts. Are you ready to take the necessary steps to secure your compliance and protect your organization?

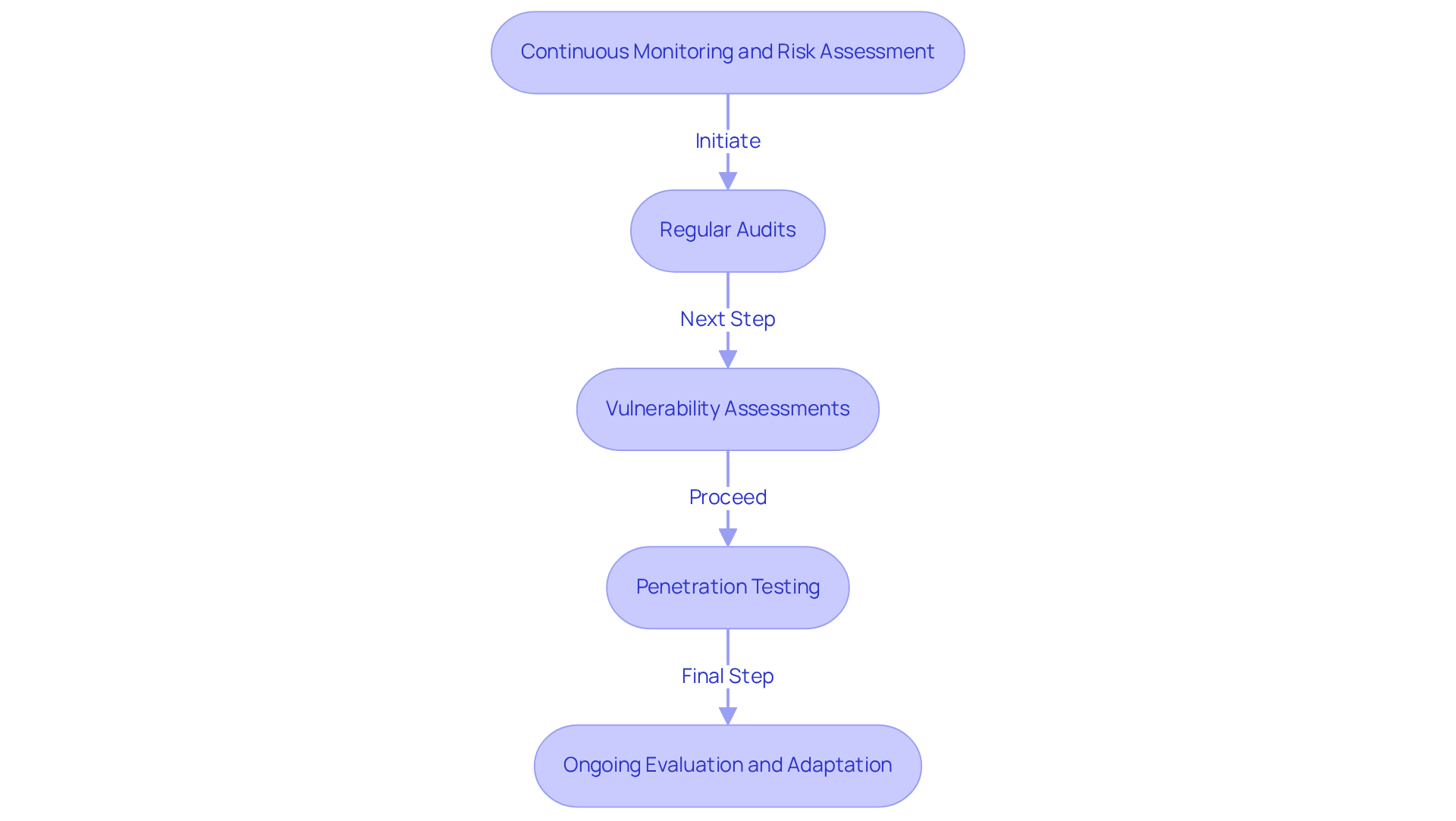

Implement Continuous Monitoring and Risk Assessment

To effectively execute ongoing monitoring and risk evaluation, organizations must establish a structured timetable for assessing their adherence status and identifying emerging risks. This process should include:

- Regular audits

- Vulnerability assessments

- Penetration testing

to uncover potential weaknesses within their systems.

Why is this important? Utilizing automated monitoring tools is crucial, as they provide real-time alerts for compliance breaches or security incidents, enabling swift responses. By fostering a culture of continuous improvement and actively seeking feedback from employees, organizations can refine their compliance strategies to counteract evolving threats and maintain a robust cybersecurity posture.

Statistics show that organizations conducting regular audits significantly enhance their compliance effectiveness. This reinforces the necessity of these practices, particularly in the defense sector. To stay ahead, organizations must not only implement these strategies but also commit to ongoing evaluation and adaptation.

Conclusion

Fintech risk and compliance in defense contracts is not just important; it’s essential. Organizations must navigate complex regulatory landscapes with diligence and precision. Adhering to standards like the Cybersecurity Maturity Model Certification (CMMC) is crucial for protecting sensitive information and ensuring operational success. By prioritizing security, transparency, and resilience, organizations can align with the expectations of the Department of Defense (DoD) and enhance their competitive edge in the contracting landscape.

To achieve effective fintech compliance, organizations should implement several best practices:

- Conduct thorough risk assessments to identify vulnerabilities.

- Develop tailored compliance programs through gap analyses.

- Leverage technology for enhanced compliance management.

- Establish continuous monitoring and risk evaluation protocols.

Each of these practices plays a pivotal role in safeguarding sensitive data and maintaining adherence to regulatory standards, ultimately fostering a culture of compliance within organizations.

In conclusion, the significance of robust fintech compliance in defense contracting cannot be overstated. Organizations must take proactive steps to secure their compliance frameworks and protect their operations from potential risks. By implementing the outlined best practices and embracing a culture of continuous improvement, entities can not only meet regulatory demands but also position themselves for success in an increasingly competitive environment. The time to act is now-ensuring compliance is not just a necessity but a strategic advantage in the realm of defense contracts.

Frequently Asked Questions

What is fintech compliance in defense contracting?

Fintech compliance in defense contracting involves adhering to regulatory standards and frameworks governing financial technology operations within the defense sector, primarily focusing on cybersecurity practices to protect sensitive information.

What is the Cybersecurity Maturity Model Certification (CMMC)?

The CMMC is a certification that outlines essential cybersecurity practices aimed at protecting sensitive information within the defense sector, serving as a key component of fintech compliance.

What are the key components of fintech compliance?

Key components of fintech compliance include data protection, risk assessment and mitigation, and compliance with federal regulations such as the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS).

Why is data protection important in fintech compliance?

Data protection is crucial as organizations must implement robust measures to shield sensitive data from unauthorized access and breaches, ensuring the security and integrity of financial operations.

What are the key fintech risks in defense contracts?

Key fintech risks in defense contracts include data breaches, inadequate cybersecurity measures, and non-compliance with regulatory standards.

How can organizations identify fintech risks?

Organizations can identify fintech risks by conducting thorough risk assessments that evaluate their current cybersecurity posture, identify vulnerabilities, and prioritize areas for improvement.

What role do third-party vendors play in fintech compliance?

Third-party vendors can pose risks if they do not meet compliance standards, making it essential for organizations to assess their compliance and security measures.

How does compliance affect eligibility for defense contracts?

Compliance with regulatory standards is increasingly tied to contract eligibility and operational success, enhancing an organization's position in the competitive contracting landscape.