Master NYDFS Cybersecurity Regulation 2023: Key Insights and Strategies

Master the NYDFS Cybersecurity Regulation 2023 with key insights and effective strategies.

Introduction

The NYDFS Cybersecurity Regulation stands as a critical pillar for protecting sensitive data within financial institutions. In 2023, it has undergone significant changes that require immediate attention from all licensed entities. This article explores the essential components of the regulation, the implications of recent amendments, and the strategies organizations can implement to ensure compliance while bolstering their cybersecurity posture.

As the stakes rise, with potential penalties for non-compliance looming large, how can institutions effectively navigate this intricate regulatory landscape? Protecting against both financial and reputational damage is paramount. By understanding the nuances of these regulations and adopting proactive measures, organizations can not only comply but also enhance their overall security framework.

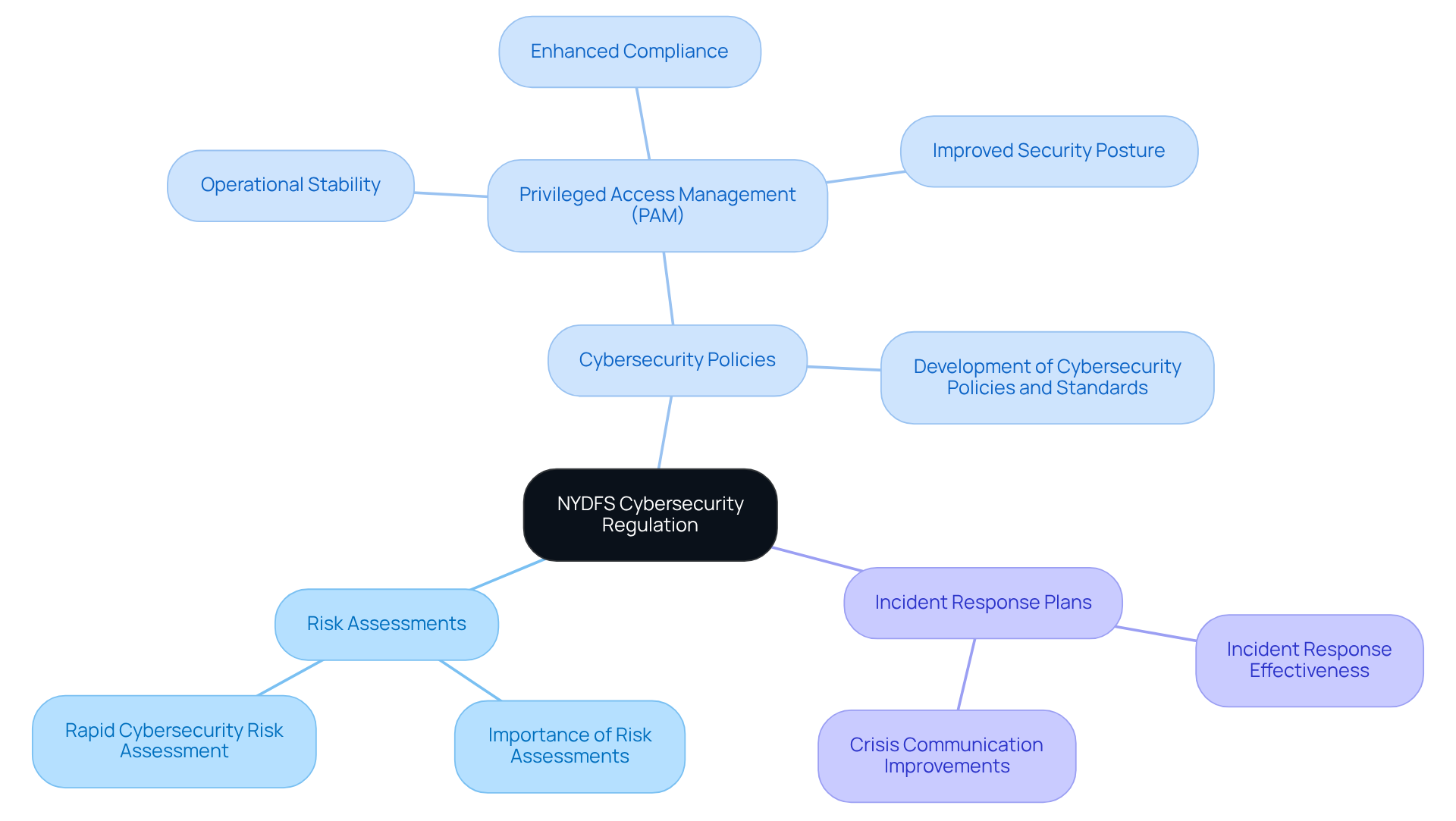

Explore the Foundations of NYDFS Cybersecurity Regulation

The New York Department of Financial Services Cybersecurity Regulation, established under 23 NYCRR Part 500, plays a crucial role in safeguarding sensitive customer data and ensuring the integrity of financial institutions' technology systems. This regulation applies to all entities licensed or registered under NYDFS, mandating the implementation of a robust information security program. Key components include:

- Risk assessments

- Cybersecurity policies

- Incident response plans

Understanding these foundations is essential for organizations to effectively manage regulations and protect their operations against cyber threats.

Successful adherence to these regulations underscores the significance of these components. For example, organizations that have adopted structured Privileged Access Management (PAM) programs have seen a significant decrease in unauthorized access. This not only improves their security posture but also ensures compliance with SOX regulations. Moreover, a thorough evaluation of potential issues can uncover control vulnerabilities, enabling organizations to develop actionable strategies that address regulatory gaps and enhance operational robustness.

The impact of the NYDFS cybersecurity regulation 2023 on financial institutions has been profound. Companies are increasingly recognizing the importance of strong protective measures. By adhering to these regulations, institutions not only safeguard their operations but also build trust with customers, ensuring that sensitive data remains secure. As the regulatory landscape continues to evolve, the emphasis on assessing potential issues and adhering to standards will remain vital for financial institutions striving to navigate the complexities of digital security effectively.

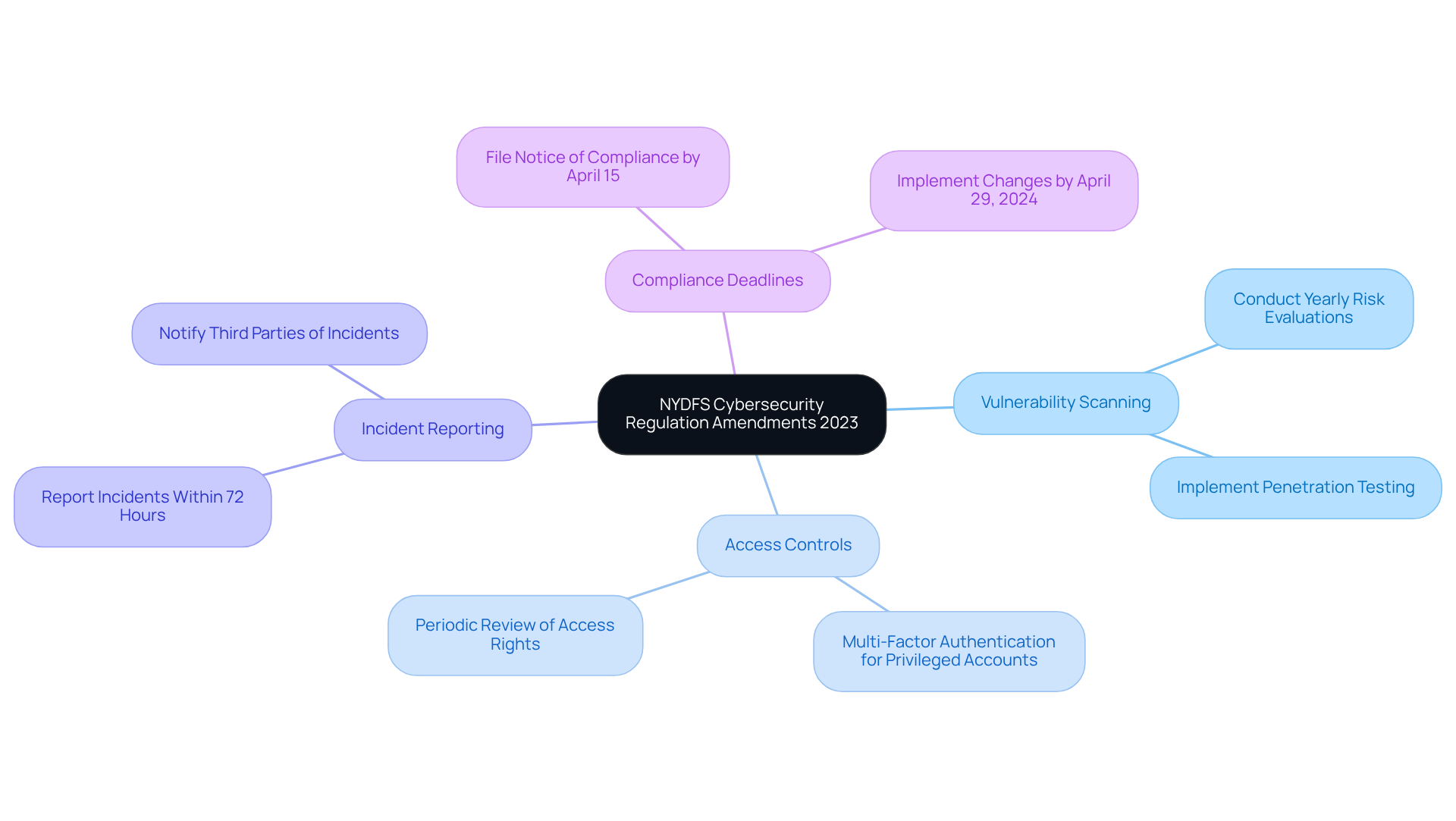

Examine Key Amendments to the Regulation in 2023

In November 2023, significant amendments to the NYDFS cybersecurity regulation 2023 were enacted, introducing enhanced obligations for covered entities. These amendments impose stricter requirements for:

- Vulnerability scanning

- Access controls

- Incident reporting

Notably, organizations are now required to conduct yearly risk evaluations and maintain thorough records of their security policies.

Moreover, new deadlines for compliance have been established, with many provisions necessitating action by April 29, 2024. Why is this important? Staying informed about the NYDFS cybersecurity regulation 2023 is crucial for organizations to avoid potential penalties and ensure robust cybersecurity practices.

To navigate these amendments effectively, organizations should prioritize understanding the new requirements and implementing necessary changes promptly. This proactive approach not only safeguards against penalties but also strengthens overall cybersecurity posture.

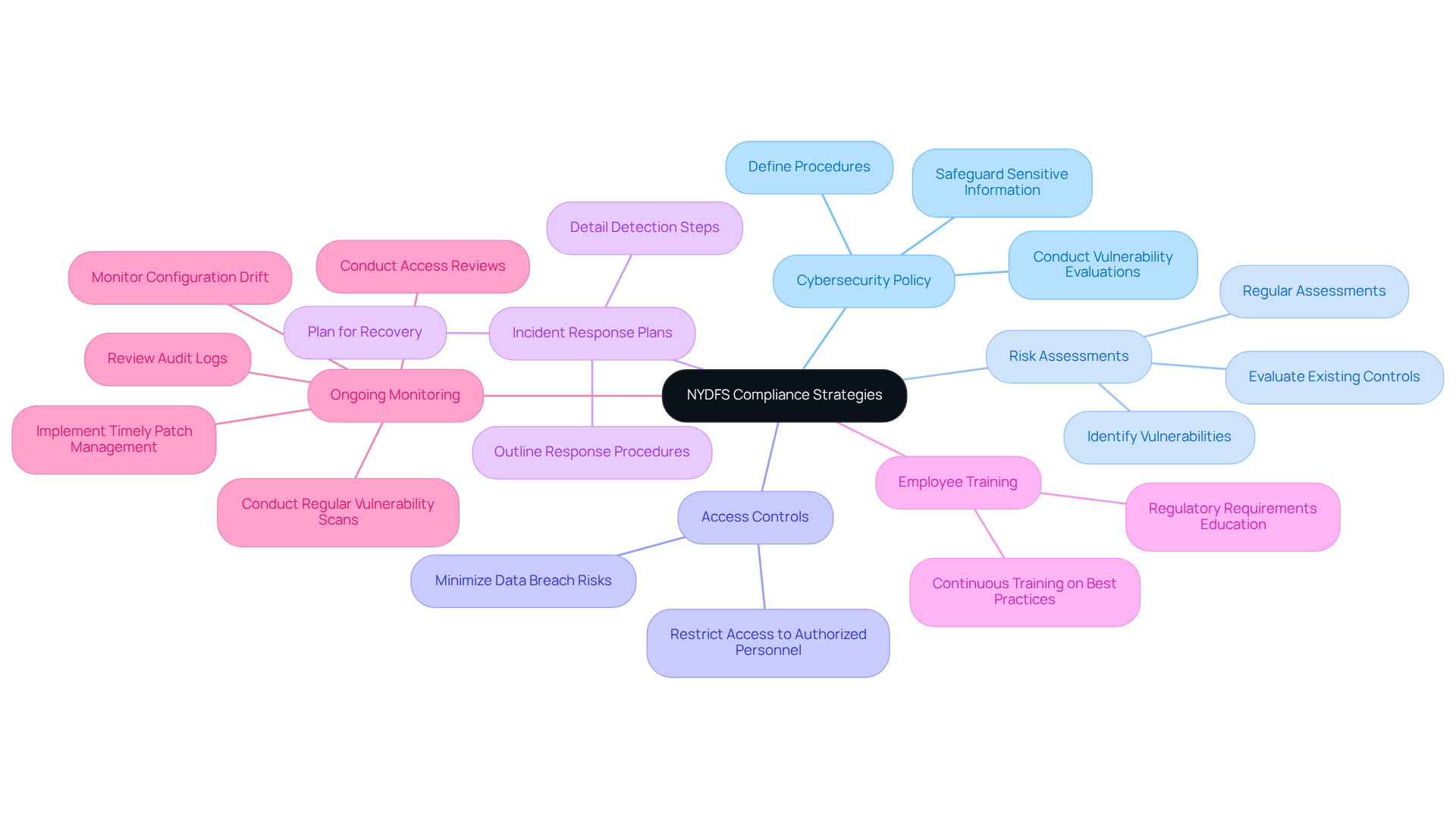

Implement Compliance Strategies for NYDFS Regulations

Achieving compliance with the NYDFS cybersecurity regulation 2023 demands a comprehensive and strategic approach. Organizations must focus on several key strategies:

-

Create a Thorough Cybersecurity Policy: This policy should clearly define procedures for conducting vulnerability evaluations, responding to incidents, and safeguarding sensitive information.

-

Conduct Regular Risk Assessments: Regular assessments are crucial for identifying vulnerabilities and evaluating the effectiveness of existing controls. Currently, only 30% of organizations consistently conduct these assessments, highlighting a significant area for improvement.

-

Implement Strong Access Controls: Access to sensitive data must be restricted to authorized personnel only, minimizing the risk of data breaches.

-

Establish Incident Response Plans: Organizations should prepare for potential breaches by detailing steps for detection, response, and recovery, ensuring a swift and effective reaction to incidents.

-

Train Employees: Continuous training on online safety best practices and regulatory requirements is essential. Regular training sessions can significantly enhance an organization's security posture.

-

Ongoing Monitoring and Maintenance: Continuously monitor and maintain security controls to ensure adherence. This includes conducting regular vulnerability scans to identify weaknesses, implementing timely patch management, reviewing audit logs for security incidents, monitoring for configuration drift, and conducting access reviews.

By adopting these strategies, organizations not only comply with the NYDFS cybersecurity regulation 2023 but also strengthen their overall cybersecurity defenses. For instance, companies like IBM and Cisco have successfully integrated regular risk assessments into their compliance frameworks, demonstrating the effectiveness of these practices in mitigating risks and enhancing security.

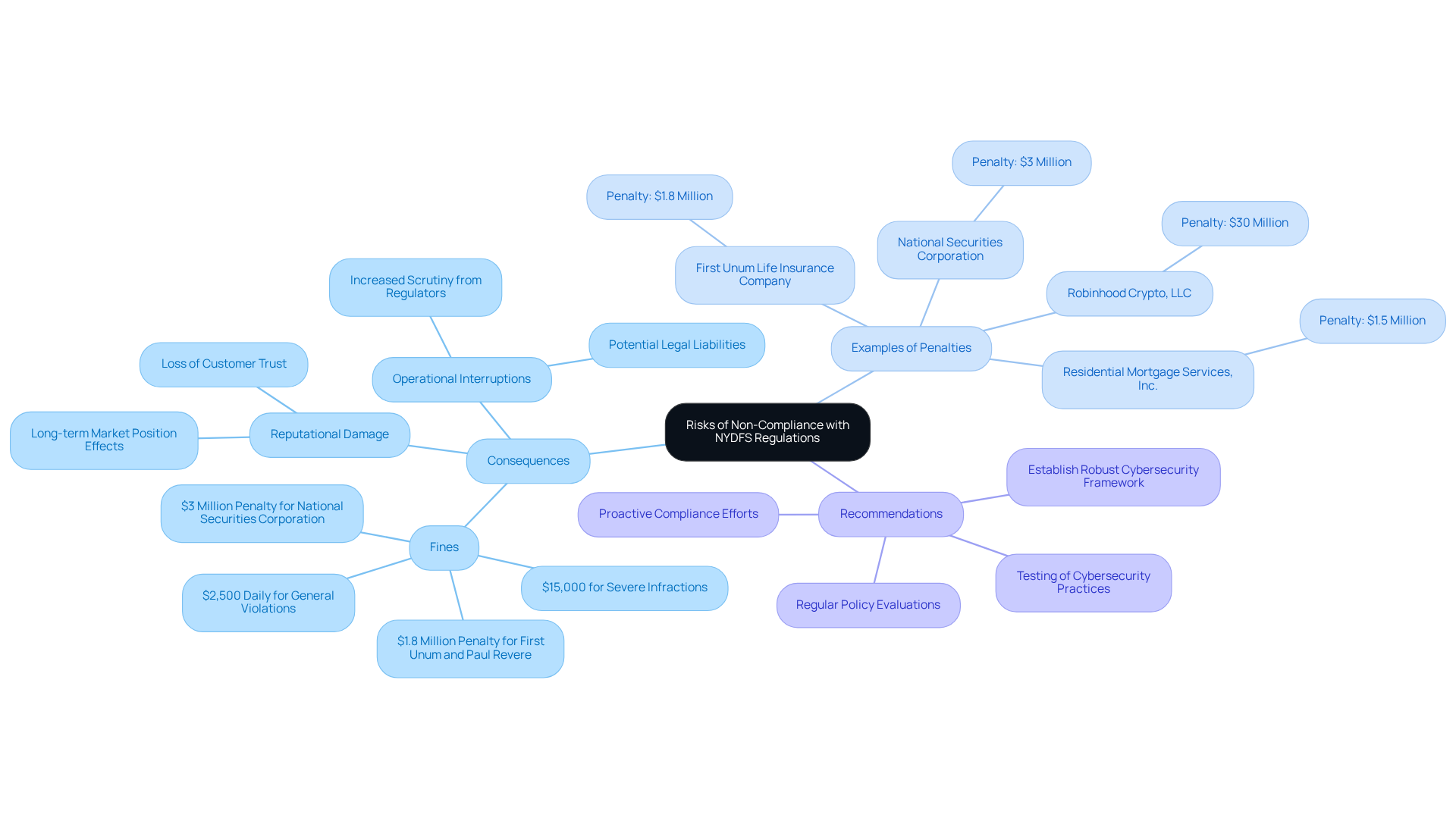

Understand the Risks of Non-Compliance with NYDFS Regulations

Non-compliance with the NYDFS cybersecurity regulation 2023 established by New York's Department of Financial Services can lead to serious consequences. These include significant fines, damage to reputation, and interruptions in operations. The New York Department of Financial Services is prepared to impose substantial penalties, with fines reaching up to $2,500 daily for general violations and escalating to $15,000 for more severe infractions.

For instance, First Unum Life Insurance Company and Paul Revere Life Insurance Company faced a combined penalty of $1.8 million for failing to adhere to cybersecurity regulations. This case highlights the financial stakes involved. Furthermore, organizations may encounter increased scrutiny from regulators and potential legal liabilities stemming from data breaches. A notable example is the $3 million penalty imposed on National Securities Corporation for failing to implement multi-factor authentication and for not reporting data breaches.

The intensity of the regulatory environment is underscored by the NYDFS's focus on examining financial institutions for compliance with the NYDFS cybersecurity regulation 2023. The reputational damage linked to such violations can be profound. Companies risk losing customer trust and may face long-term effects on their market position. As Jayant W. Tambe observes, financial institutions ought to evaluate their policies and assess their practices related to digital security to mitigate these risks.

Understanding these factors emphasizes the necessity for proactive compliance efforts and the establishment of a robust cybersecurity framework. This framework is essential to safeguard against potential violations.

Conclusion

The NYDFS Cybersecurity Regulation 2023 stands as a crucial framework for financial institutions, underscoring the necessity for robust cybersecurity measures to safeguard sensitive data and uphold operational integrity. By mandating comprehensive security protocols and regular risk assessments, this regulation not only fosters compliance but also cultivates trust with customers, emphasizing the critical need to protect information in our increasingly digital world.

Key insights throughout the article highlight the foundational elements of the NYDFS regulations, such as:

- Risk assessments

- Incident response plans

- Stringent access controls

The recent amendments introduced in 2023 further amplify the urgency for organizations to remain vigilant and proactive in their cybersecurity efforts. Companies must prioritize understanding and implementing these updated requirements to mitigate the risks of non-compliance, which can result in severe financial penalties and reputational harm.

In light of the evolving regulatory landscape, it is imperative for organizations to adopt a comprehensive approach to cybersecurity compliance. By embracing best practices like:

- Regular training

- Thorough policy development

- Ongoing monitoring

Institutions can not only meet regulatory expectations but also enhance their overall cybersecurity posture. The time to act is now; proactive measures will not only shield against potential penalties but also strengthen the trust that customers place in their financial institutions.

Frequently Asked Questions

What is the NYDFS Cybersecurity Regulation?

The NYDFS Cybersecurity Regulation, established under 23 NYCRR Part 500, is a regulation that aims to safeguard sensitive customer data and ensure the integrity of financial institutions' technology systems.

Who does the NYDFS Cybersecurity Regulation apply to?

The regulation applies to all entities licensed or registered under the New York Department of Financial Services (NYDFS).

What are the key components of the NYDFS Cybersecurity Regulation?

The key components include risk assessments, cybersecurity policies, and incident response plans.

Why is it important for organizations to understand the foundations of the NYDFS Cybersecurity Regulation?

Understanding these foundations is essential for organizations to effectively manage regulations and protect their operations against cyber threats.

How can organizations improve their security posture under the NYDFS regulations?

Organizations that adopt structured Privileged Access Management (PAM) programs can see a significant decrease in unauthorized access, thereby improving their security posture and ensuring compliance with regulations like SOX.

What is the impact of the NYDFS cybersecurity regulation on financial institutions?

The impact has been profound, as companies are increasingly recognizing the importance of strong protective measures, which helps safeguard their operations and build trust with customers regarding the security of sensitive data.

How does adherence to the NYDFS regulations benefit financial institutions?

Adhering to these regulations not only protects operations but also builds customer trust by ensuring that sensitive data remains secure.

What should financial institutions focus on as the regulatory landscape evolves?

Financial institutions should focus on assessing potential issues and adhering to standards to navigate the complexities of digital security effectively.