Master SOX Compliance Security: Best Practices for Defense Contractors

Master SOX compliance security with essential practices for defense contractors to safeguard operations.

Introduction

Understanding the complexities of the Sarbanes-Oxley Act (SOX) is essential for defense contractors navigating the intricate landscape of regulatory compliance. This legislation not only imposes stringent financial reporting standards but also acts as a foundation for building trust with stakeholders, including the Department of Defense. Given the high stakes - ranging from severe penalties to reputational damage - how can defense firms effectively implement SOX compliance while maintaining operational efficiency?

This article explores best practices, essential requirements, and innovative technological solutions that empower defense contractors to meet SOX standards and secure their competitive edge. By delving into these strategies, firms can not only comply with regulations but also enhance their operational integrity and stakeholder confidence.

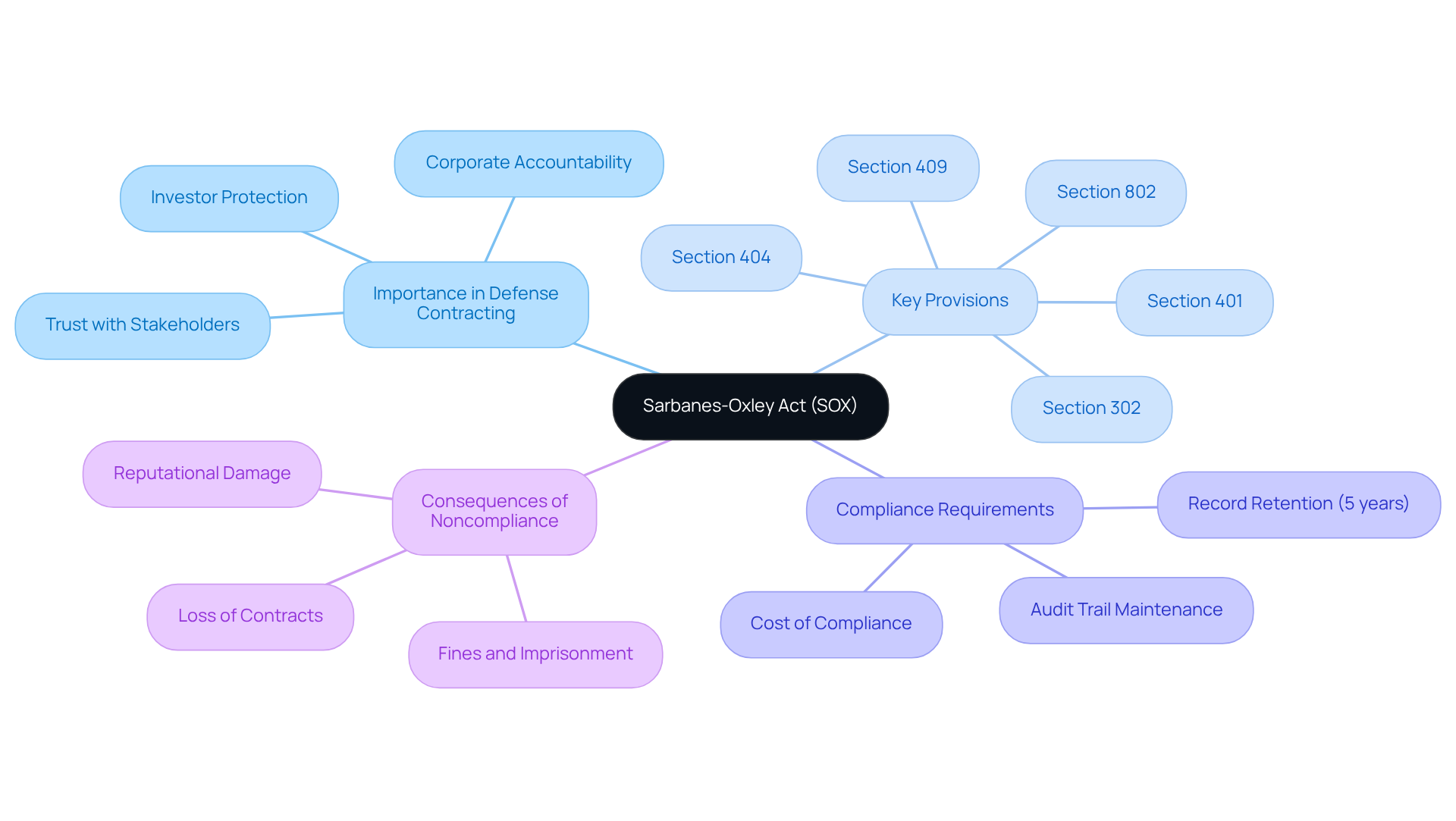

Understand the Sarbanes-Oxley Act (SOX) and Its Importance in Defense Contracting

The Sarbanes-Oxley Act (SOX), enacted in 2002, stands as a fundamental pillar for investor protection, enhancing the accuracy and reliability of corporate disclosures. For defense firms, grasping the nuances of SOX is crucial. Why? Because it imposes stringent regulations on financial reporting and internal controls, particularly through key provisions like sections 302, 401, 404, 409, and 802.

SOX compliance security not only strengthens corporate accountability but also fosters trust with essential stakeholders, including the Department of Defense (DoD). The stakes are high; noncompliance can lead to severe repercussions such as hefty fines, imprisonment, and the loss of contracts, not to mention significant reputational damage. In fact, statistics reveal that 5% to 7% of SEC-registered companies report significant deficiencies in their audit reports. This underscores the critical need for rigorous adherence to SOX.

Moreover, the Sarbanes-Oxley Act mandates that all business records, including electronic ones, be retained for a minimum of five years. This requirement is particularly vital for defense suppliers, who must diligently comply. As the defense contracting landscape evolves in 2026, prioritizing SOX compliance security transcends mere regulatory obligation; it becomes a strategic imperative for maintaining eligibility for government contracts and ensuring robust financial practices.

Experts emphasize that while the costs associated with SOX compliance security can be substantial, the benefits of enhanced transparency and accountability far outweigh these challenges. Are you ready to take the necessary steps to ensure compliance and safeguard your organization’s future?

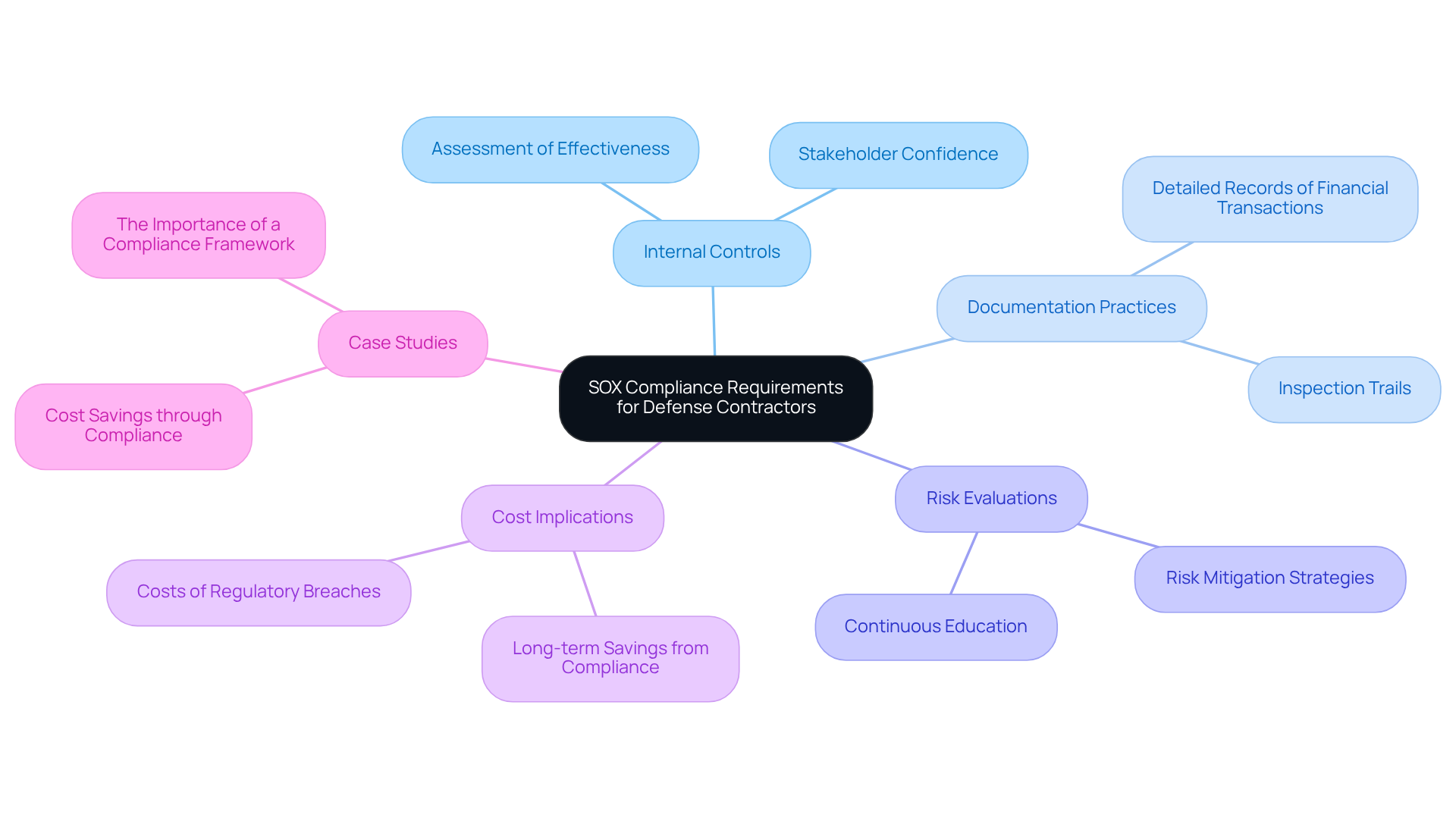

Identify SOX Compliance Requirements for Defense Contractors

Defense suppliers face critical obligations under the Sarbanes-Oxley Act (SOX) related to SOX compliance security, particularly regarding internal controls over financial reporting. Have you considered how these regulations impact your operations? Section 404 requires companies to assess and report on the effectiveness of their internal controls, a necessity for maintaining stakeholder confidence. To comply, builders must implement thorough documentation practices, including:

- Detailed records of financial transactions

- Inspection trails

- Risk evaluations

This structured approach not only prepares defense contractors for audits but also significantly reduces the risk of non-compliance.

In fact, organizations that prioritize adherence to regulations can save costs in the long run. The expenses associated with a regulatory breach far exceed those of effective compliance management. Continuous education and improvement in compliance practices are essential. Industry experts emphasize that without a robust compliance framework, organizations may overlook critical security measures until it’s too late.

Currently, a significant percentage of defense firms are meeting SOX compliance security requirements, which reflects a growing recognition of the importance of these standards in enhancing operational resilience and security. Furthermore, 'The Ultimate Guide to Achieving CMMC Compliance' serves as a roadmap for defense companies, offering practical strategies and peer insights that reinforce the necessity of maintaining effective policies and ongoing monitoring practices.

Consider the case study titled 'Cost Savings through Adherence.' It illustrates how effective adherence protocols can prevent substantial financial losses, reinforcing the argument that investing in compliance is ultimately beneficial for organizations. Are you ready to take action and ensure your compliance practices are up to par?

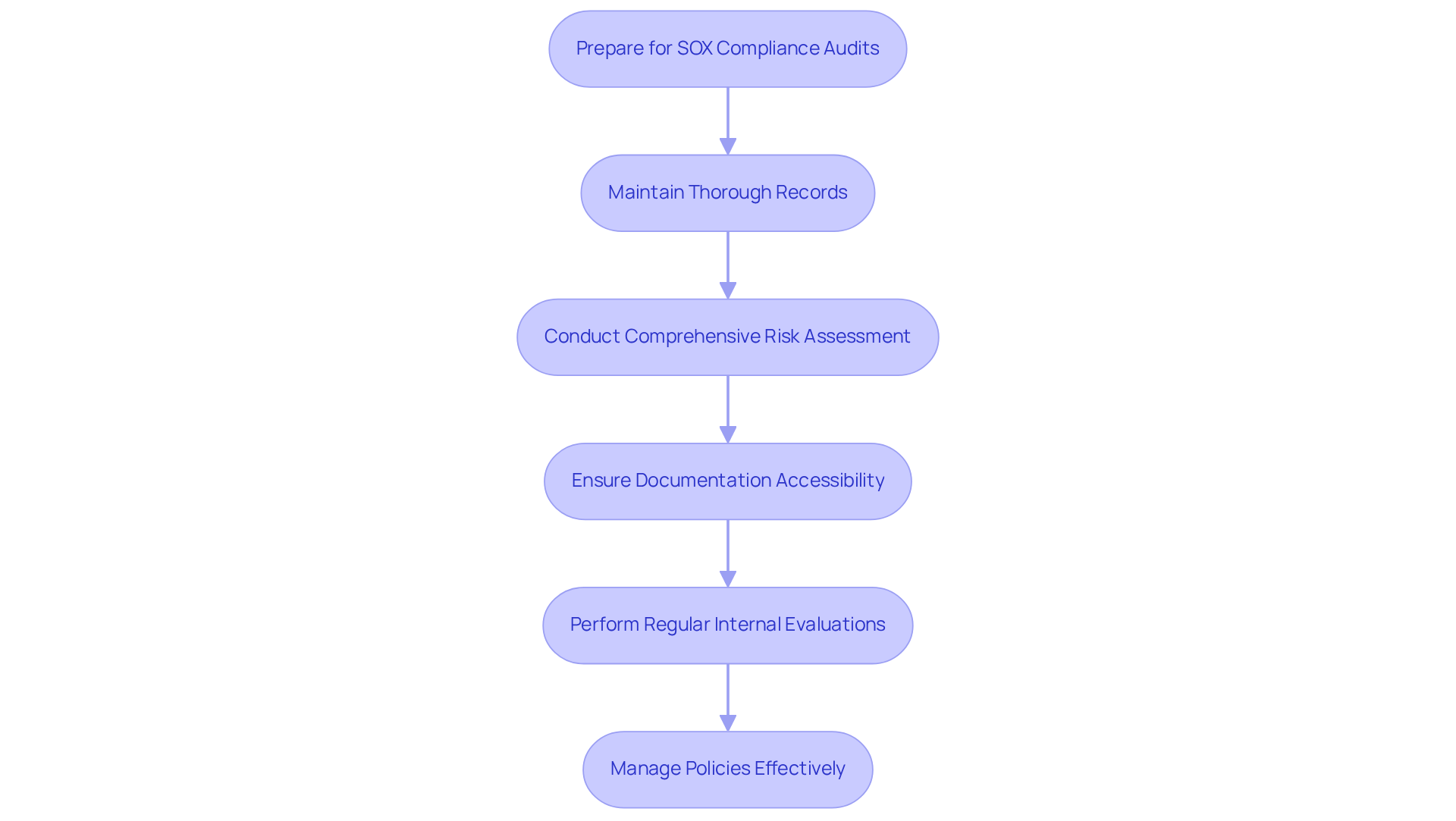

Prepare for SOX Compliance Audits with Effective Documentation and Strategies

To prepare effectively for evaluations of SOX compliance security, defense contractors must adopt a structured documentation approach. This includes maintaining thorough records of financial transactions, internal controls, and inspection trails. Why is this important? A comprehensive risk assessment is crucial for identifying potential compliance gaps. By creating clear records for all financial activities, organizations ensure transparency and accountability. Moreover, making documentation easily accessible for reviewers is vital for a seamless examination process.

Regular internal evaluations can further pinpoint areas for improvement, allowing organizations to address concerns before the official review. Additionally, effective policy management practices are essential. This involves:

- Reviewing policies at least annually

- Establishing a formal process for proposing and approving changes

- Maintaining version control

- Archiving previous policy versions

Have all personnel been informed of policy changes? Communicating these changes to everyone affected is critical to ensure compliance.

By prioritizing documentation, strategic audit preparation, and comprehensive policy maintenance, builders significantly enhance their chances of a successful regulatory audit, which is crucial for SOX compliance security. This proactive approach not only mitigates risks but also fosters a culture of compliance that can lead to long-term success.

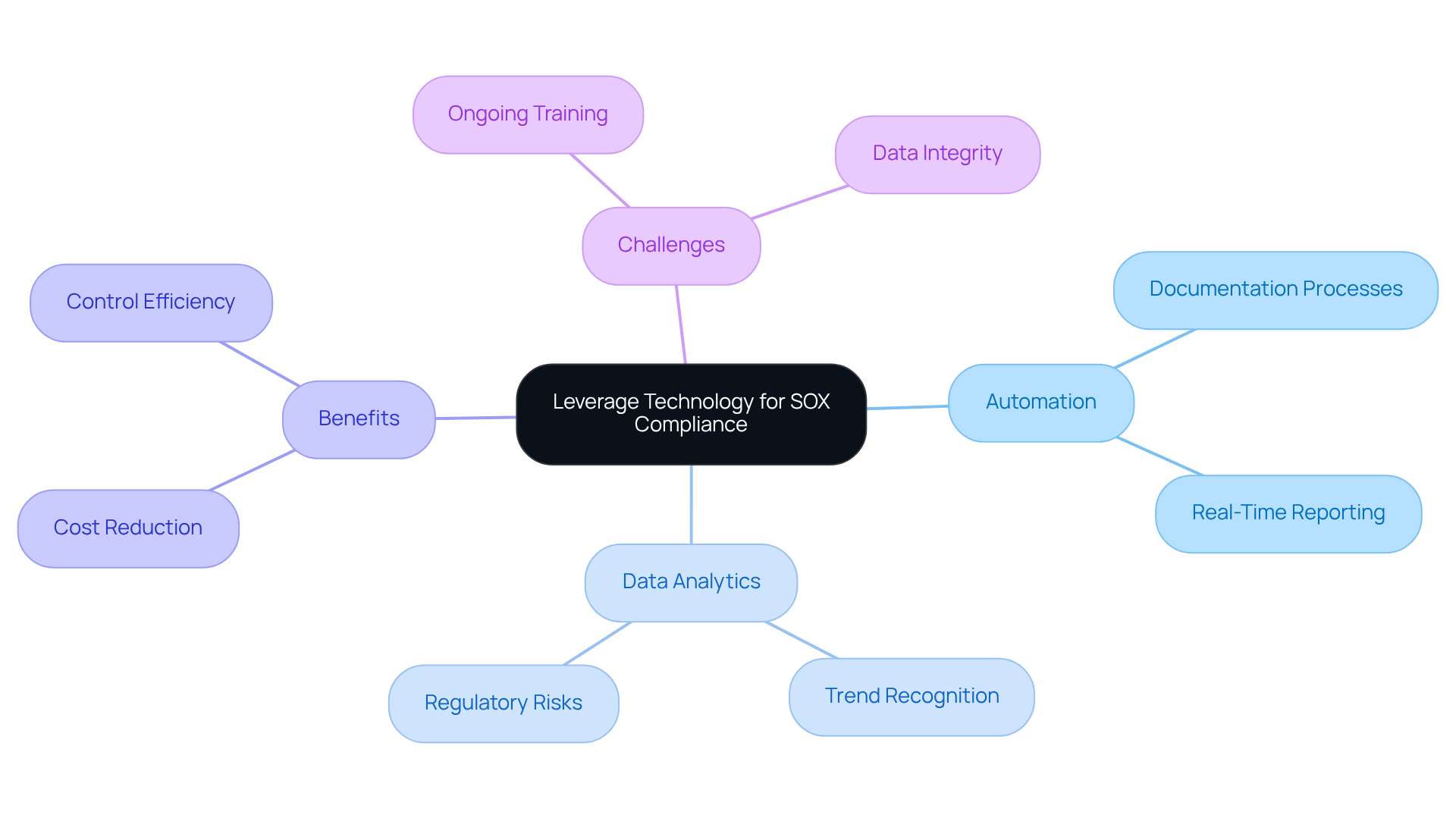

Leverage Technology and Software for Enhanced SOX Compliance

Incorporating technology into SOX compliance security efforts can dramatically enhance both efficiency and accuracy for defense contractors. But how can this be achieved? By employing management software, organizations can automate documentation processes, monitor adherence status, and enable real-time reporting. For instance, audit management systems centralize documentation and streamline communication with auditors, making the audit process more efficient.

Moreover, utilizing data analytics allows organizations to proactively recognize trends and potential regulatory risks, facilitating timely interventions. As Cassie Putnam observes, "There are many areas throughout the regulatory lifecycle where companies can put technology to good use - from the scoping of risk assessments to control testing - especially regarding automating repetitive manual processes."

By adopting these technological solutions, defense contractors can significantly enhance their regulatory stance while easing the challenges linked to manual processes. Statistics from PwC indicate that a tech-enabled approach to SOX compliance security lowers costs while boosting control efficiencies, underscoring the strategic advantage of adopting such tools.

However, organizations must also be aware of potential challenges. Ongoing training is essential, and ensuring data integrity is crucial to avoid misapplication of these technologies. Are you ready to embrace technology and elevate your compliance efforts?

Conclusion

Understanding and implementing SOX compliance security is not merely a regulatory requirement for defense contractors; it’s a vital strategy for maintaining operational integrity and stakeholder trust. The Sarbanes-Oxley Act provides a framework that guides organizations in enhancing their financial reporting and internal controls-elements that are crucial in the highly scrutinized defense industry. Adhering to these standards is essential for safeguarding against potential penalties, reputational damage, and ensuring eligibility for government contracts.

Key aspects of SOX compliance have been explored, including:

- The importance of internal controls

- Thorough documentation practices

- The integration of technology to streamline compliance efforts

Proactive measures, such as regular audits and leveraging management software, can significantly enhance compliance efficiency and accuracy. Moreover, the financial benefits of maintaining rigorous compliance practices far outweigh the initial costs associated with implementing them.

In a landscape where regulatory compliance is increasingly critical, the call to action is clear: defense contractors must prioritize SOX compliance not only to meet legal obligations but also to foster a culture of accountability and transparency. Embracing best practices and technological advancements will prepare organizations for successful audits and position them as trustworthy partners within the defense sector. Taking these steps is not just about compliance; it’s about securing a sustainable future in a competitive industry.

Frequently Asked Questions

What is the Sarbanes-Oxley Act (SOX)?

The Sarbanes-Oxley Act (SOX) is a law enacted in 2002 aimed at protecting investors by enhancing the accuracy and reliability of corporate disclosures.

Why is understanding SOX important for defense firms?

Understanding SOX is crucial for defense firms because it imposes strict regulations on financial reporting and internal controls, which are essential for maintaining corporate accountability and trust with stakeholders, including the Department of Defense (DoD).

What are the key provisions of SOX that defense firms should be aware of?

Key provisions of SOX include sections 302, 401, 404, 409, and 802, which outline requirements for financial reporting and internal controls.

What are the consequences of noncompliance with SOX?

Noncompliance with SOX can result in severe repercussions, including hefty fines, imprisonment, loss of contracts, and significant reputational damage.

How prevalent are deficiencies in SOX compliance among companies?

Statistics indicate that 5% to 7% of SEC-registered companies report significant deficiencies in their audit reports, highlighting the importance of rigorous adherence to SOX.

What record retention requirements does SOX impose?

SOX mandates that all business records, including electronic records, be retained for a minimum of five years, which is particularly important for defense suppliers.

Why is SOX compliance security considered a strategic imperative for defense contractors?

As the defense contracting landscape evolves, prioritizing SOX compliance security is essential for maintaining eligibility for government contracts and ensuring strong financial practices.

What are the benefits of SOX compliance despite its costs?

Experts suggest that while the costs associated with SOX compliance can be substantial, the benefits of enhanced transparency and accountability significantly outweigh these challenges.